An electronic money institution (EMI) is not a bank. Although people often use these words interchangeably, they refer to different things. Banking regulations and operations differ from those of an EMI. This blog will shed light on the functions of electronic money institutions and the principles of an e-money license.

What is an electronic money institution?

An electronic money institution is a legal person holding a license to issue electronic money or e-money. Only a competent supervisory authority in a particular country grants a license for such activities.

For example, Malta is a country with solid positioning in e-commerce. The authorized institution to issue such licenses there is the Malta Financial Services Authority (MFSA). The supervisory financial regulator in Lithuania is the Bank of Lithuania.

In the European Union, all the institutions that grant electronic money institution licenses comply with Directive 2009/110/EC. This directive is the legal basis for e-money issuance.

In a broad sense, EMIs regulated by the EU can offer the following services:

- Issuance, distribution, or refund of electronic money

- Payment services to perform transactions with e-money, including but not limited to:

- Cash withdrawals from a payment account

- Transfer of funds to third parties

- Money remittance

- Payment cards, which includes taking out cash from a card and depositing cash to the payment card by customers

- Providing account information

With this in mind, it is crucial to understand that EMIs do NOT:

- Offer bank accounts because they cannot receive deposits;

- Have deposit guarantees, i.e. customers funds up to €100,000 are not protected under the European Deposit Insurance Scheme;

- Provide borderless execution of payment transactions, i.e. money transfers might be subject to certain jurisdictions and particular currencies.

Despite these few limitations, electronic money institutions are on the increase. The European Union, in particular, has picked up a tailwind. These days, the EU is experiencing a surge in the number of e-money institutions and e-money transaction volumes. As of June 2020, almost 500 electronic money institutions were operating in Europe. Poland, Belgium, Portugal, and Lithuania are taking the lead.

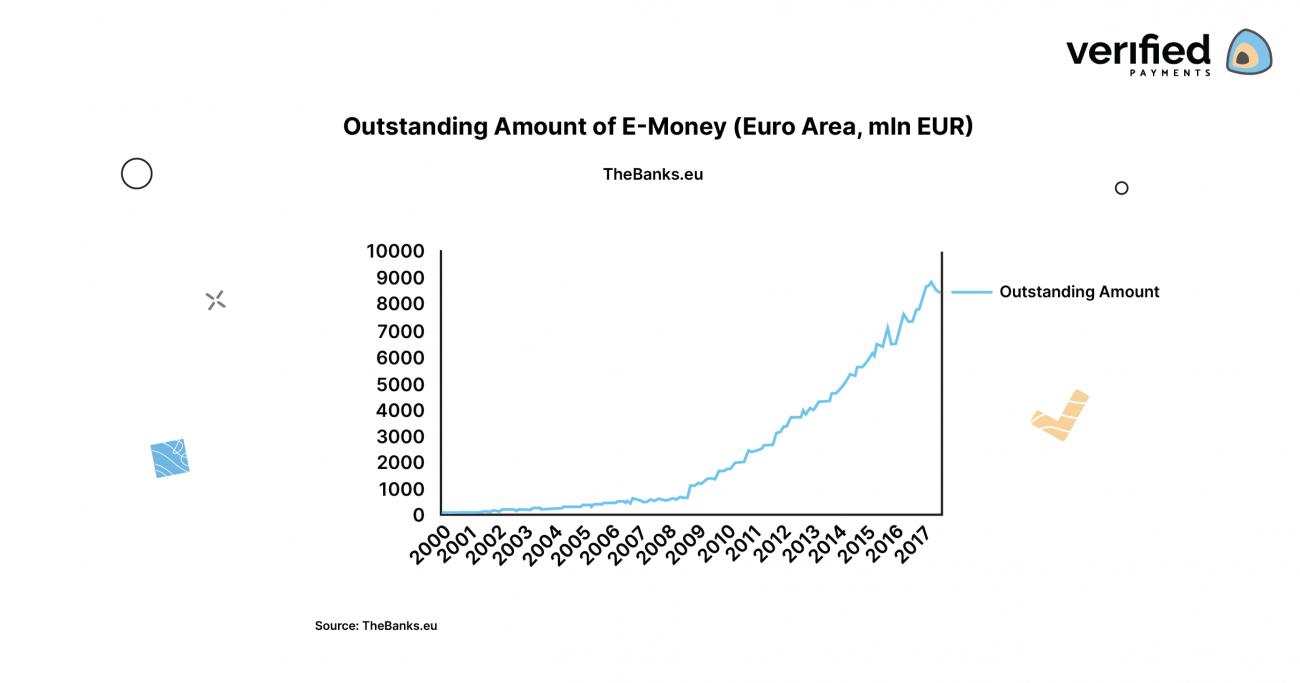

In addition, the outstanding amount of e-money within the euro area has increased almost ten times since 2000.

- The outstanding amount of E-money in Europe

Source: TheBanks.eu.

What is an e-money license?

An electronic money institution license is a document that allows an EMI to issue electronic money. As said before, only competent supervisory authorities grant a license for such activities.

The Lithuanian regulator, the Bank of Lithuania, distinguishes between two types of companies with Electronic Money Institution License Lithuania:

- Full EMI License Lithuania, i.e. an electronic money institution holding a license issued in Lithuania for non-limited activity; and

- Small EMI License Lithuania, i.e. electronic money institution with a license issued in Lithuania for restricted activity.

Both types of companies can issue electronic money and provide payment services. Their operations and services are regulated by the Law on Electronic Money and Electronic Money Institutions and the Law on Payments. Both unrestricted and small EMIs can be public or private limited liability companies.

By and large, a company with an E-money License Lithuania for restricted activity can perform two functions:

- Issue and redeem e-money. Clients can hold funds converted to e-money on an online account (an e-wallet) until they make payments using those funds.

- Provide the same financial services as payment institutions in Lithuania except for payment initiation and account information services.

However, the Small Electronic Money Institution License Lithuania is valid for services provided only in Lithuania. As a result, small EMIs cannot issue electronic money and provide payment services in the other EU Member States. That is why so few companies apply for the Small E-money License Lithuania.

There are also other limitations for small EMIs. First, the average outstanding e-money of a small EMI must not exceed EUR 900,000.00. Second, the average of the preceding twelve months’ total amount of transactions cannot go over EUR 3,000,000.00 per month. The latter applies when a small EMI provides payment services other than the issuance of e-money.

On the other hand, the requirements for restricted institutions are less stringent. Thus, a restricted activity does not need any initial or ongoing own capital. What is more, unlike fully licensed EMIs, companies with a restricted activity do not need to follow the requirements for shareholders.

For more information on shareholders and voting rights, refer to Articles 24 and 25 of the Law on Banks.

Requirements for EMIs

To become an EMI, a financial institution must go through many steps. Below, we will share the process that Verified Payments went through in Lithuania to become a fully certified EMI. E-money license requirements and the process of acquiring it varies from country to country. Yet, the key elements are almost the same in each of them.

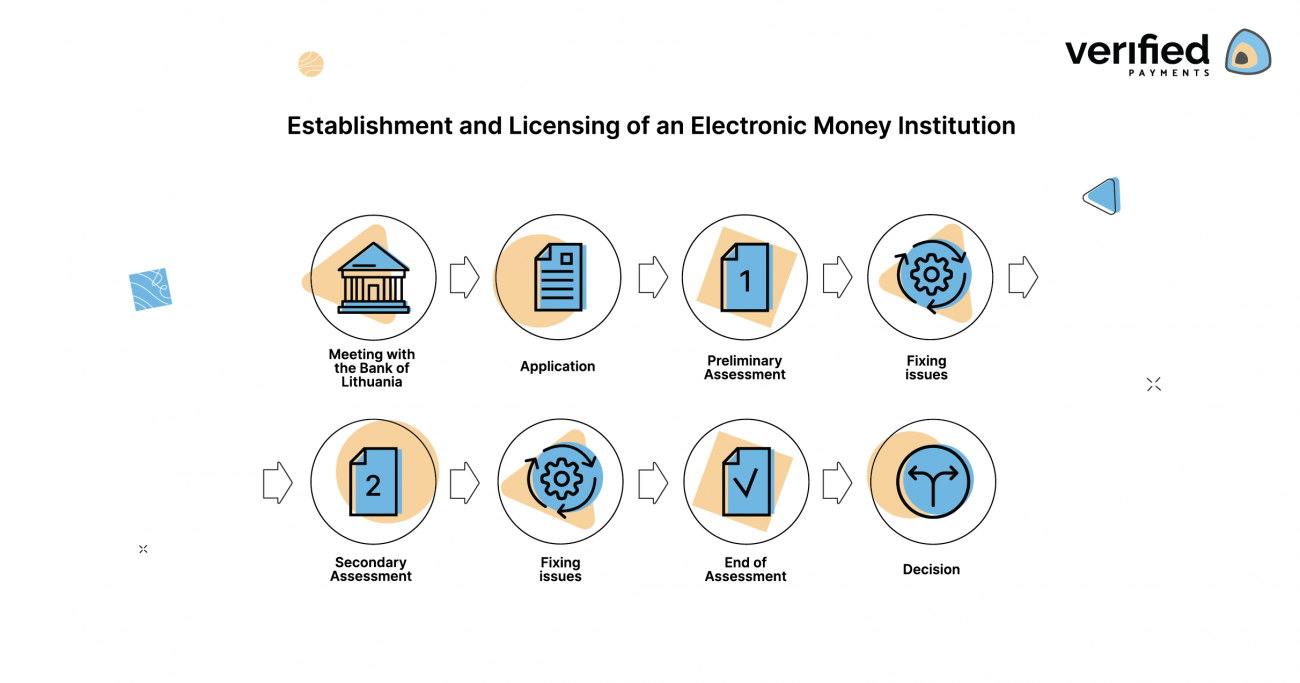

- Steps to acquire E-money license and become Electronic Money Institution

Preparation for a pre-application meeting with the Bank of Lithuania.

We can group the minimum requirements for any institution applying for unrestricted activity into three sections:

E-money license costs.

Electronic money institutions holding a license for the unrestricted activity must comply with minimum initial capital and own funds requirements. An EMI must have a minimum initial capital of no less than EUR 350,000.

In addition, an EMI is subject to the own fund’s requirement. It says that an EMI must account for no less than 2% of the average outstanding electronic money. The own funds of an electronic money institution must not go above the larger of the two values: own funds calculated according to a selected method or the minimum initial capital.

Safeguarding client funds.

An EMI directly receiving funds must safeguard them by following one of these methods:

- holding them in a separate account opened with a credit institution or a central bank of Lithuania or another Member State;

- investing these funds in liquid low-risk assets; or

- covering the funds by an insurance contract or obtaining a guarantee or a surety bond.

Insurance for electronic money institutions.

An EMI that provides account information or payment initiation services must have either professional indemnity insurance or another guarantee against liability.

A pre-application meeting with the Bank of Lithuania.

If you suit the requirements and ratios mentioned above, you will have to arrange a meeting with the Bank. This is when an applicant will answer a barrage of questions about their would-be EMI.

These include but are not limited to: Who are the owners and major capital investors? What is their country of origin? How advanced or developed is the applicant’s proposition? Are the details of the products/services, target markets, and delivery channels clear enough? What is the pricing policy? What is the applicant’s funding model?

Preparation & submission of an electronic money institution application.

Before applying for an EMI license, it is necessary to pay a state levy for granting the EMI license. Currently (May 2021), it is EUR 1,463. The collector of the payment is the State Tax Inspectorate (STI). The sizes of levies are established by Resolution No 1458 of 15 December 2000.

The fee above is just the tip of an iceberg. An applicant must collect a rather big pile of detailed documents. Besides, all of them have to follow the requirements of legal acts set by the Bank. The documents must outline the shareholders or holders of voting rights and heads of an electronic money institution. Overall, the documents must show the fitness and propriety of the EMI.

An applying EMI must have a detailed procedure of how it will manage electronic money issuance activities. It means that an application must present an organizational structure showing the differentiation of functions and responsibilities. What is more, an EMI must present its ways of monitoring risk, administrative measures, and accounting system.

Assessment of the electronic money institution application.

This stage is one of the longest and takes great patience. After assessing the initial application, the Bank of Lithuania will provide the first round of comments. An applicant will change their application accordingly and then wait for another round of comments from the Bank.

The circle might repeat itself a few times, even becoming a vicious circle. This might take a while because of a series of meetings and discussion sessions with the Bank.

This is a pretty lengthy process, isn’t it? So, how long does it take to get an EMI license? Theoretically, the Bank of Lithuania makes a final decision within three months of receiving a complete application. In reality, it takes somewhere in the region of 4 months to get the electronic money institution license in Lithuania.

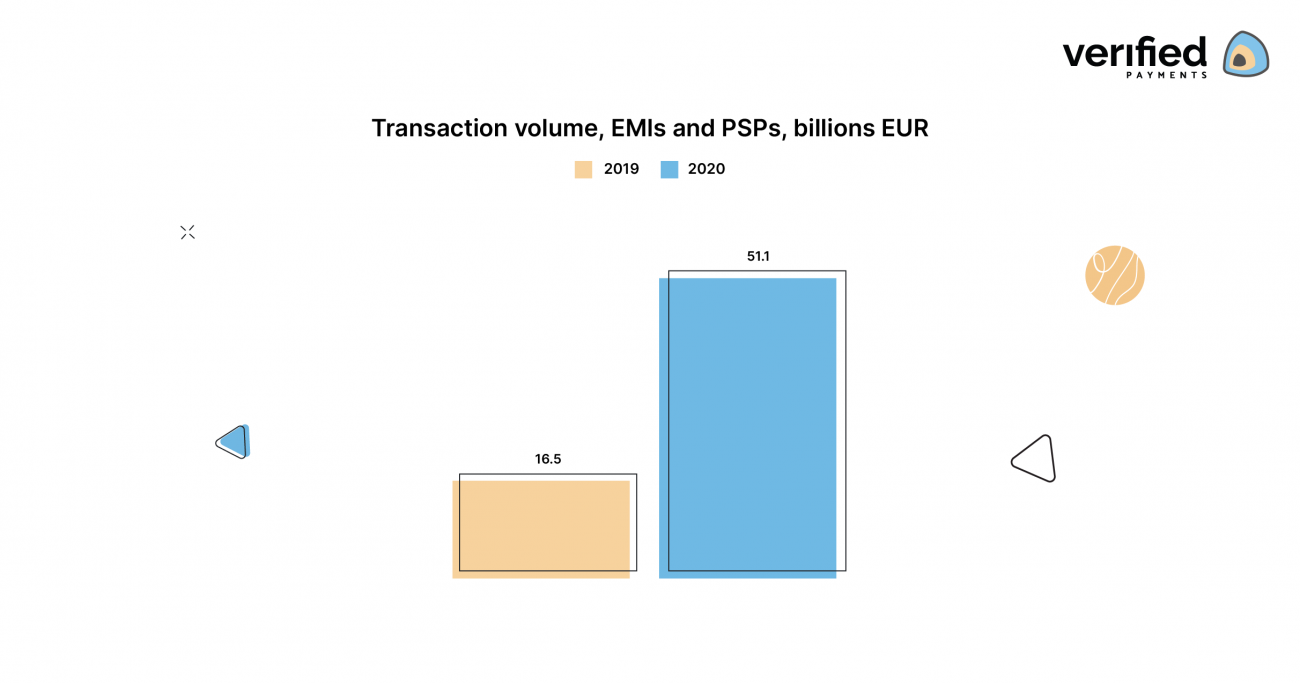

The transaction volume of EMIs and PSPs, 2019-2020

Source: The Bank of Lithuania.

The current environment for an electronic money institution in Lithuania is like…

As mentioned before, Lithuania is among the most attractive countries to acquire an electronic money institution. The Bank of Lithuania regularly issues licenses, publishes guidelines, and proposes various initiatives that further develop the fintech sector. Moreover, to attract foreign businesses, the Bank provides most of the information in English.

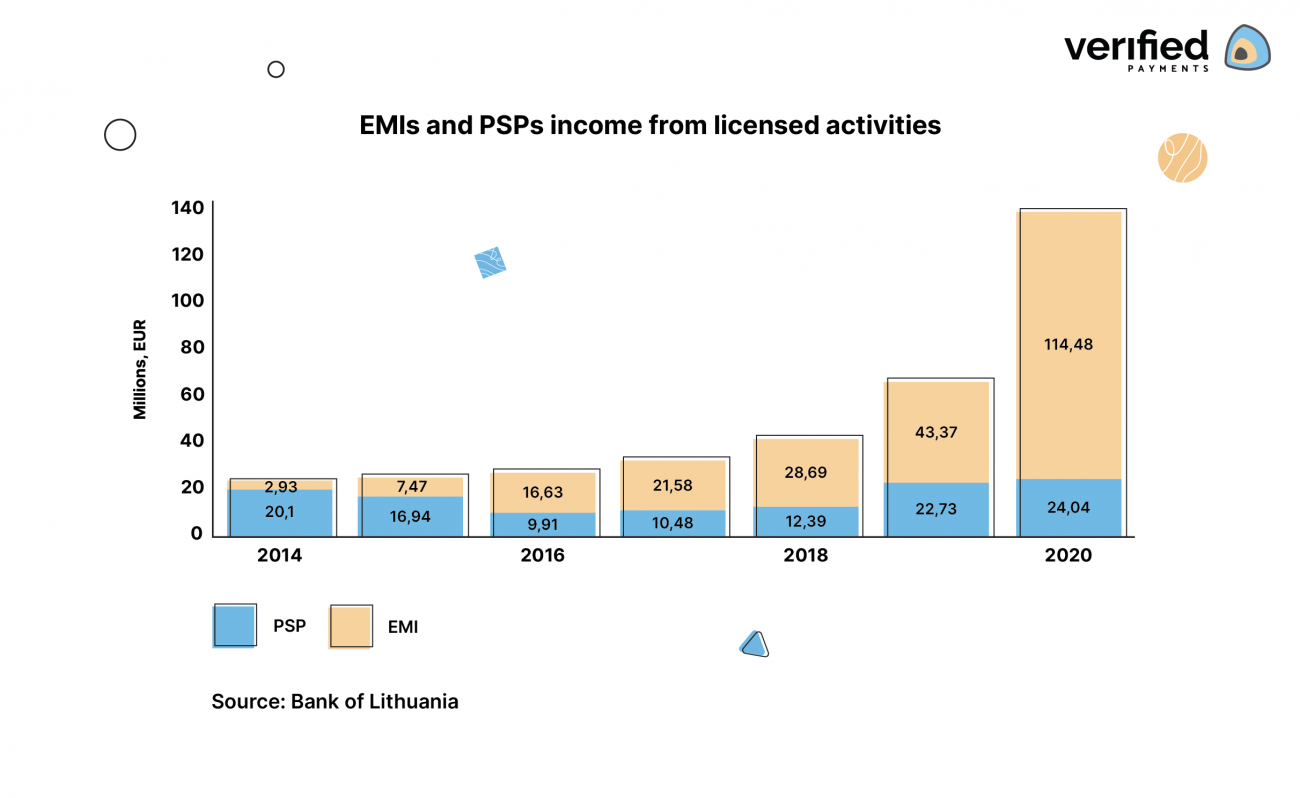

Income of Electronic Money Institutions and Payment Service Providers in Lithuania

Source: The Bank of Lithuania.

These are some of the reasons why Verified Payments acquired an EMI license in Lithuania. Besides, our experience shows that quite a number of jurisdictions may not grant permission to issue e-money. This may be due to a lack of knowledge of this innovative financial environment and business model.

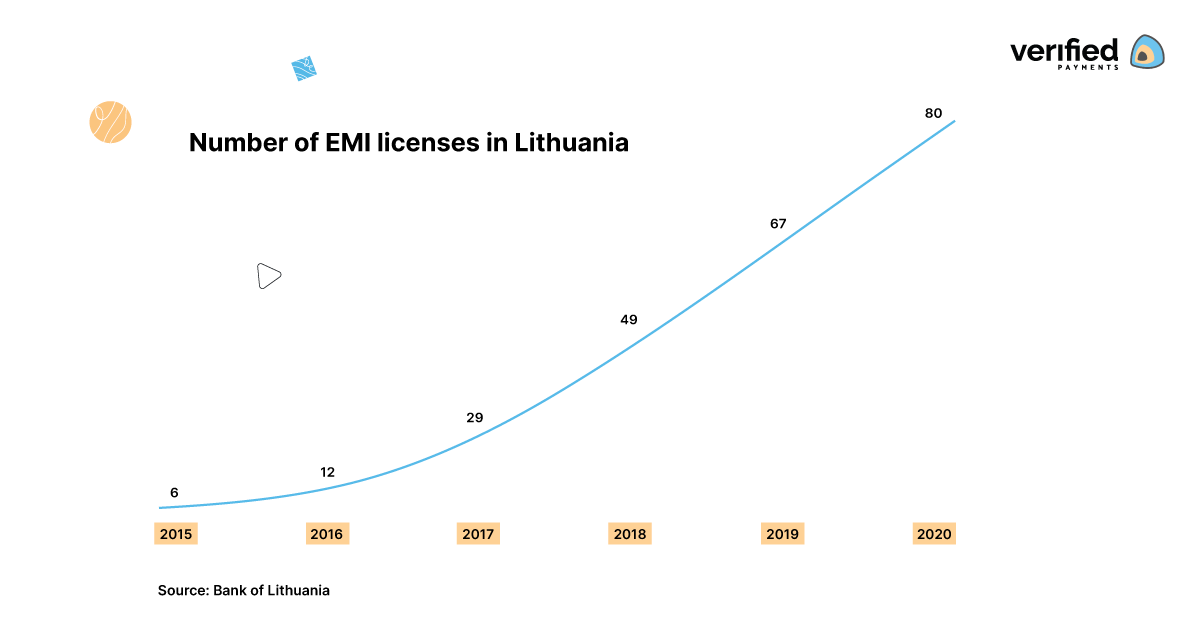

To wrap up, let us share some statistics from the website of the Bank of Lithuania. In Q4 2020, income from electronic money issuance and payment services reached EUR 114.4 million. Last but not least, the Bank supervises 80 electronic money institutions as of May 2021.

Number of EMI licenses in Lithuania, 2015-2020

Source: The Bank of Lithuania.

Benefits of Electronic Money Institution License Lithuania

The EMI License Lithuania enables you to provide a lot of services. Below you will find the services that Verified Payments, holding the status of an EMI Lithuania, can provide under its license:

- Issuance of IBANs to your customers

- SEPA instant payments without any correspondent banks

- Access to 31 SEPA countries

- Dedicated EUR and multi-currency accounts

- Virtual and physical card program

- Local payments (payment initiation)

- Control your customer fees

- Instant balance updates

Verified Payments as your e-money partner

Are you thinking of conducting activities related to creating electronic money in the EU? Get a professional consultation free of charge! Contact us by phone at +370 616 59976 or [email protected].