According to an ongoing tendency, customer digital-only behavior has provoked intense competition in the market and made various vendors seek help from financial providers to meet the growing appetites of sophisticated consumers.

As a result, embedded finance has taken the financial world by storm and evolved into an unimaginable $43 billion industry, with its growth to continue in 2022.

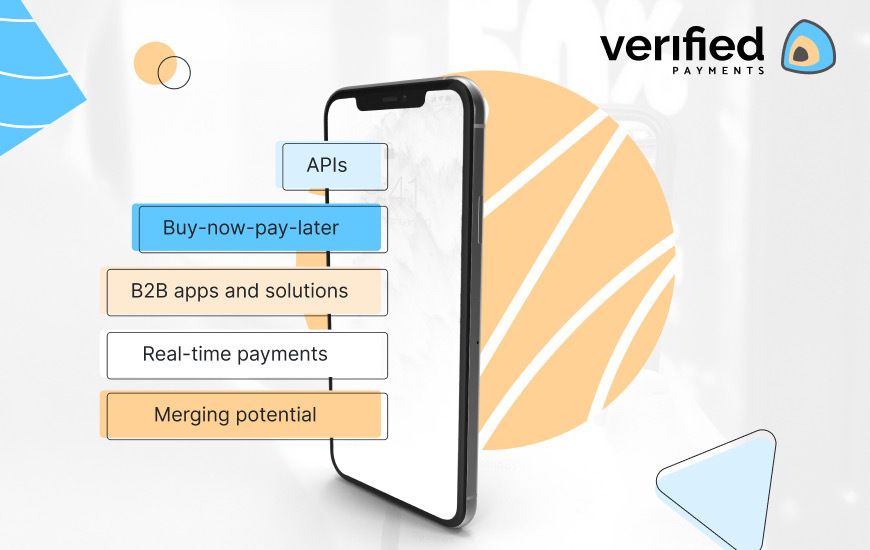

Since embedded investment programs have hit the business arena and made it even more accessible for new participants, 2022 is believed to contribute a lot to the seamless integration of financial services into non-financial platforms. So, here are the top five trends to expect this year.

Buy-now-pay-later (BNPL)

The first generation of embedded finance was all about payments: fintech companies, retailers, and countless other providers issuing their own payment cards. However, with the development of technologies, lots of vendors started to look for alternatives that would give their customers more flexibility to shop what they want, when they want, and without breaking the bank. This aspiration, in turn, has spawned a BNPL model.

Today, the buy-now-pay-later option is gaining more and more popularity, which can be explained by increasing appreciation among the millennials and the Gen Z community. Moreover, the BNPL scheme is even expected to become mainstream in 2022. The giants such as PayPal, Amazon, and Klarna that have already integrated BNPL predict an explosive boost in sales, as their customers will be able to get exactly what they need for flawless online shopping.

Interestingly, it has been reported that BNPL transactions accounted for about 6% of all online spending in 2021 will hold 13% of all online transactions by 2025, and that can’t be ignored.

An incredible boost in B2B apps and solutions

The first generation of embedded finance focused mainly on the end consumer, and at that time, such an approach seemed to be quite successful. But over time, since the fintech sector is constantly looking for new perspectives, there has been a significant shift of the focus toward B2B applications.

Verified Payments, for instance, in addition to guaranteeing its customers to get paid in time, offers full-service business solutions, including multi-currency accounts, global money transfers, virtual cards, and access to working capital – and that is only one of the countless examples.

Thus, the number of B2B embedded finance applications will skyrocket in the current year, and solutions like lending and insurance are likely to be added as essential parts of any business.

The boom of APIs

Actually, the technology of plugging financial products or services into a business is not unique. Since the mid-2010s, more and more businesses have been turning to a business model that enables any company’s key service to be utilized as a part of another business’s broader solution.

In fact, APIs on their own are not enough to run the digital ecosystem; they are simply the entrance to the digital products that a business plans to release.

However, since APIs have an excellent combination potential, the integration of new services can give an extra advantage in ongoing market competition. Furthermore, APIs can provide a clear idea of whether your product is in demand and what chance it has to attract other players.

Therefore, APIs as a trend will enable more providers to pick any services they’d like to incorporate, which, in turn, will result in a multitude of productive partnerships and a wide array of products and services to satisfy even the most sophisticated users.

Global real-time payments

Global payments seem to have been neglected over a long time period. But now, real-time payment solutions have a great chance to grow and accelerate development and innovation in the area of embedded finance. With low cost and reliability, instant payments generate numerous benefits for all parties involved in the transfer. Financial institutions accessing the data in real-time can improve the customer experience, enhance the existing infrastructure, and provide new products and services.

The popularity of real-time payments will continue to grow in the B2B market as well, as more businesses leverage real-time payments to better manage liquidity and risks.

In fact, real-time payments have already become a standard in almost every country, and in 2022, fast cross-border transfers are believed to become global. As a result, multiple businesses will be able to enter a global market and significantly extend their customer portfolios, while consumers will enjoy frictionless payment experiences.

Great merging potential

Throughout the pandemic, customers have been opting for a more digital-only experience, which, in turn, led to an enormous spectrum of previously undiscovered opportunities.

Not so long ago, embedded finance focused mostly on sectors like eCommerce and retail, but soon it is expected to spread its impact on numerous other industries and sectors, unlocking a huge supply of untapped potential. Fintech experts have released a report identifying the leading sectors — apart from retail and eCommerce — health, education, real estate, and employment can expect a successful integration with financial services right in 2022.

Of course, one may argue that some of these sectors are still on their way to digitalization, and it’s early to discuss their combination with financial services. Nevertheless, when it comes to embedded finance and the speed of digitalization, there is much space to act, as giving the customers an excellent chance to enjoy new and beneficial products and services is a good incentive.

To sum it up

The nature of the financial landscape is changing by leaps and bounds, which already enabled embedded finance to extend banking products outside the four walls of a bank and turn them into an unforgettable user experience. Moreover, due to the uptake of embedded finance, consumers got a clear idea of what they want and what they expect.

In the effort of making financial experiences more smooth and invisible to the end user, embedded finance continues to bring together financial institutions, technology players, and other companies from industries outside of finance. And indeed, this is not about banks and non-banks, but about cooperation and something genuinely helpful that each player in the ecosystem can offer.