In our last blog post, we talked about the differences between banking as a service (BaaS) and banking as a platform (BaaP). Today, we are going to discuss open banking, its differences from BaaS, and its everyday benefits for us.

Historic perspective

For centuries, banks have had a monopoly over the information about their customers. Not only their financial data but private information, like marital status, as well. In modern times, banks can quite accurately guess customers’ behavioral patterns, interests, and lifestyles. All they have to do is combine the demographic data that they already have with the knowledge about our spending habits. This makes banks one of the few organizations that have such direct access to our personal information.

Unauthorized access to this information would have led to severe direct financial consequences and loss of reputation and trust. Banks chose the most effective method at that time to deal with the responsibilities they had. To protect themselves and their customers they isolated themselves from others and did not share the information they owned.

However, in the late twentieth century, technological development showed that the situation could change. And eventually, it did. It took decades but open banking came into the scene and some say that it was inevitable for traditional banks.

What does open banking mean?

According to the Bank of Lithuania, a European central bank that licensed Verified Payments, open banking can be defined as follows:

“Open Banking is a system based on application programming interface (API) and intended for sharing financial information necessary for the development of financial products and services. Contrary to the conventional centralized management of financial data, it relies on a technological network of different financial institutions, enabling them to exchange information more efficiently.”

To put it another way:

It allows non-banks to offer banking functionality.

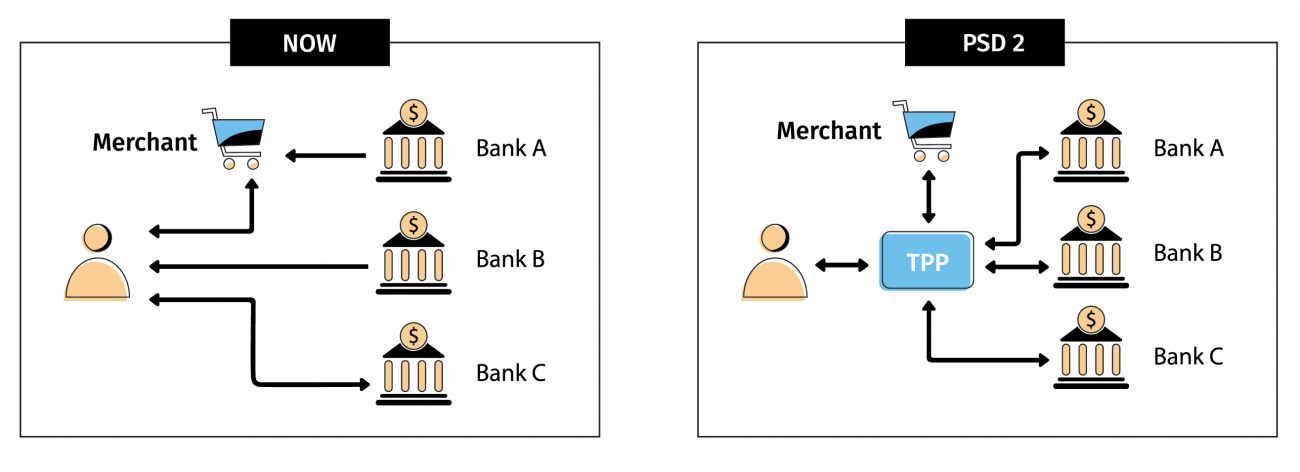

It is as simple as that. A customer authorizes trusted apps to access their information. Such apps are run by third-party providers that cannot access the data without the consent of a customer. Also, they cannot do that in a non-secure and non-standardized way. In order to access customer account information or financial information, these apps use a technology called open banking APIs.

Open banking allows apps run by third-party providers can access user data with the prior consent of a customer.

The purpose

It might seem that the sole purpose of open banking was to allow sharing customers’ data between banks and nonbanks. Yet, that is not entirely true. The main goal was to increase competitiveness between financial institutions. As traditional banks were comfortable with the monopoly they had over customers, there was not a lot of innovation in the field.

As Imran Gulamhuseinwala summarized during the interview with Wired.co.uk:

“People are paying too much for their overdrafts; money is sat in current accounts not earning interest; there’s not enough switching.”

Just a few years ago it was our financial reality. Now at any given moment, we can compare conditions for financial services and pick the most relevant for us. Moreover, we can open banking account online in minutes. Open banking broke the monopoly banks had. It did so by making them share information that we allow to be shared with the companies that we trust. A competitive environment turned out to be great for end-users.

Benefits of open banking

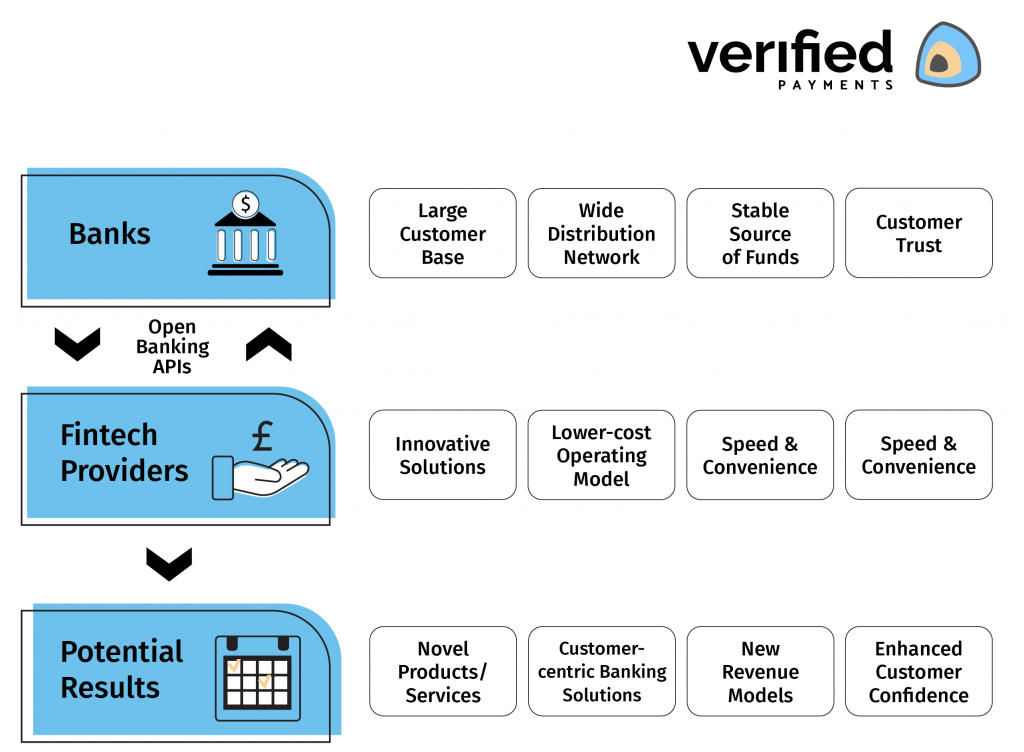

For starters, it opened up opportunities for non-banking companies to offer banking products and services to the market. It turned out that these non-banks knew their way around user-friendly designs and seamless, streamlined procedures. Also, they offered speed, lower costs, and greater convenience. Quickly their solutions started competing with products and services usually provided by traditional banks. Although these advantages and competition in the financial sector look great, open banking gave us even more:

- A better understanding of your finances

Open banking allows you to see all your finances in one place. These apps help you to set a budget, find the best deals and purchase the right products and services for you. You can choose to give a regulated app or website secure access to your current account information.

- Quick, easy, and direct payments

Purchase goods or services via an eCommerce platform seamlessly and directly from your bank.

- Ability to shop around

Open banking extends choice as customers can select from multiple service providers. It also empowers customers to take charge of their finances and make informed decisions to manage their accounts.

Benefits of Open Banking

These benefits did not seem groundbreaking at the beginning but it was only a matter of time until they were recognized worldwide. Today, however, people enjoy them not even knowing that they come from open banking. They became our everyday companions, without which we could not imagine our lives.

8 use cases of open banking that benefit customers

So, how exactly opening bank information benefited us – the customers? Bellow, you will find actual open banking use cases that we cannot imagine our lives without:

- Making purchases on mobile devices, remittances, and currency conversions more convenient.

- Offerings of customized products.

- Personalization of banking services.

- Accessing multiple accounts from a single app to monitor your financial status and purchases.

- Enjoying the best deals with greater transparency. All financial data in one place means better credit decisions and more lucrative deals.

- Nearly instantaneous credit and remittance.

- A variety of payment methods such as credit cards, buy-now-pay-later, and the like.

7 open banking examples

We shortlisted several examples of open banking companies in action. There are hundreds more. Most often open banking providers are fintech startups that build their success stories on being third-party providers but some larger tech companies and even banks develop open banking applications, too.

- Cleo is an AI chatbot that helps its customers to track their spending, save money, and reach their financial goals.

- Cake brings together all bank accounts and transactions into a single app.

- Moneybox and Plum help their customers by streamlining saving and investing.

- Tully is the first completely digital debt adviser in the UK. It already helped over 13,000 people to build a budget online to understand their financial circumstances and, if needed, provide and set-up debt advice.

- Plaid acts as an intermediary between financial apps and banks so that app users can log in and share their data securely.

- Trustly is a payment method that allows customers to shop and pay from their online bank account, without the use of a card or app.

Honorable mention. Services of Revolut were not built around open banking but this fintech unicorn incorporated it into its services. Revolut uses it to let you see your external account balances and transactions on the platform (it also allows checking Revolut balances with external providers).

Is open banking safe?

The short answer is Yes.

Long answer:

It employs APIs (technology used to share information) that are considered safe. On top of that, providers of such services are regulated by governmental institutions. It is needed to say that the regulation differs across countries. Although, we will not cover them now as they are technical nuances that are out of the scope of this post.

What are the implications of open banking for banks?

The impact of open banking on banks has tremendous effects, such as the following:

- It provided an opportunity for banks to stay ahead of the competition. They employed new functionalities provided by fintech and non-financial institutions.

- The model allowed banks to understand the changes they needed to adapt for a better customer experience.

- Open banking APIs helped banks to enhance their appeal as an entity by fulfilling the constantly changing demands of both existing and prospective customers.

Conclusion

It is hard to imagine now that not a long time ago we had to visit a bank branch physically to open an account or use a certain service. Open banking changed the market, the players, and the customers in just a few years. Just like the internet started slowly and snowballed into the reality-shaping phenomenon that it is today, open banking can rediscover and evolve financial services.

Isn’t it exciting to see what improvements the upcoming years will bring to the financial industry? Stay tuned for more articles on our blog.