Private-label and white-label banking allow introducing banking services to your customers easier than you’d expect. All you need is a laptop, a logo, and a marketing team.

As easy as it sounds, launching such services can differ. The longest and hardest path is building core banking systems on your own. A much cheaper, easier, and quicker approach is utilizing the benefits of private-label or white-label banking solutions.

To be honest, you can use the concepts of “private-label” and “white-label” interchangeably at times. For example, when you refer to rebranded premade software or services in general. Yet, as the name of this blog post suggests, these concepts do not mean the same. It is not entirely correct to call a private-label solution white-label, and vice versa.

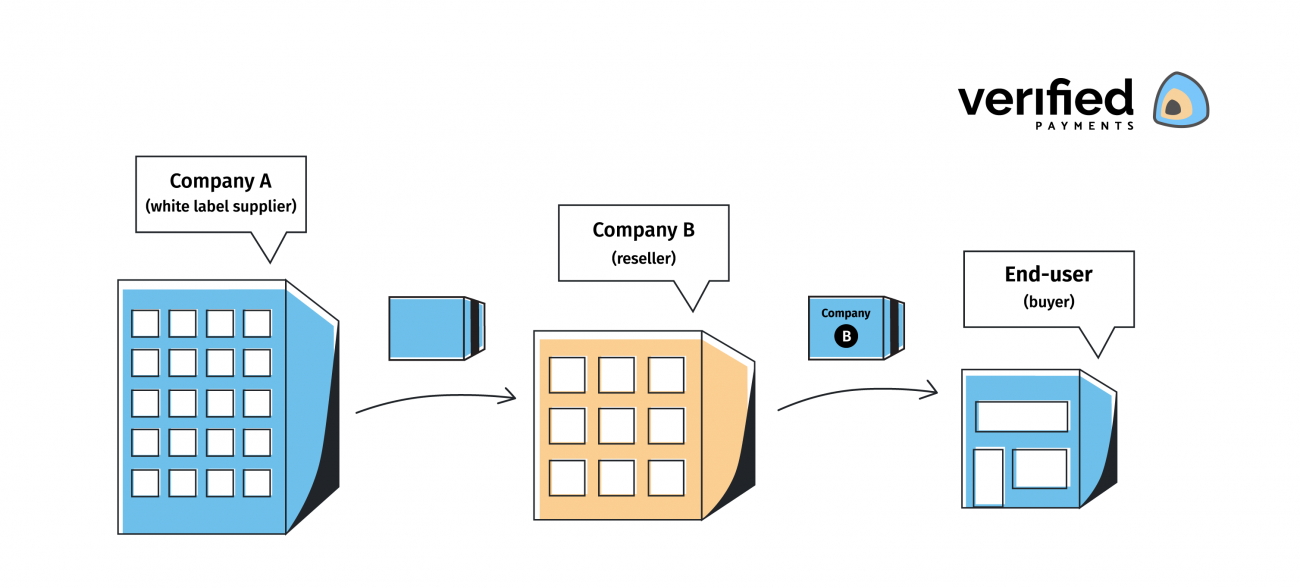

White-label banking means that one company has everything to provide banking services and provides a complete package to other companies. These can rebrand the whole package and offer banking services to their customers.

What is a white-label?

According to Investopedia:

White label products are sold by retailers with their own branding and logo but the products themselves are manufactured by a third party.

Similarly, white-label banking means that one company has a license, software, infrastructure, human resources, and so on and so forth. In short, it has everything to provide banking services*. So, this company packs the aforementioned everything into a convenient solution and other companies can purchase. The latter businesses can rebrand the whole package and offer banking service(s) to their customers.

“White-label” implies purchasing a solution “as it is”. It is possible to change only the visible parts of the solution, i.e. the exterior. You cannot change the core features of the solution. Usually, the provider of a white-label solution specifies what and how they deliver. They also set the standards for the services.

In this case, a company offering white-label solutions can provide the same solutions to other brands. Most often it is an expert in the field and it has the processes, tools, and systems polished.

Benefits of white-label banking:

- A reselling company acquires a new stream of revenue by offering additional services to customers.

- A reselling company can charge its customers a premium. Because of their position on the market, different retailers can charge differently for the same products.

- A reselling company does not spend a fortune on developing banking infrastructure and acquiring a license.

- White-label solutions allow focusing on business development, branding, and marketing.

Summing up

White-label solutions provide huge advantages for young companies and little-known startups. It allows entering the market significantly more quickly and requires less investment and experience. Although it is not free of charge, customizing white-label solutions ask for little to no expenses.

What is a private-label?

Just like white-label products, private-label products are manufactured by one company but sold under another company’s brand. But in terms of customization, private-label is the opposite of white-label. Usually, in private-label banking, the end product is customized even before it gets labeled.

Private-label means high levels of customization to all aspects of banking products and services. In theory, the control of the design of your products and services is entirely in your hands.

It is important though to mention that private-label solutions are mostly used for physical products because modifying such solutions is very complex. Private-label products are popular in the beauty industry, household items manufacturing, outfit, and other types of physical goods.

Private-label offers an opportunity for smaller players to compete with more recognizable brands. For example, a retailer can offer a similar style of outfit for a lower price compared to other well-known clothing providers.

White-label vs private-label banking

As covered above, both business models mean banking services that are developed by one company and sold by another under the brand of the latter company. Both are great in the sense that reselling companies do not have to develop banking services and can focus on marketing and sales.

The key difference is that white-label banking products or services are generally uncustomized whilst private-label ones provide more customization options. In banking, white-label solutions usually are the go-to choice as the customization of banking products and services is complex.

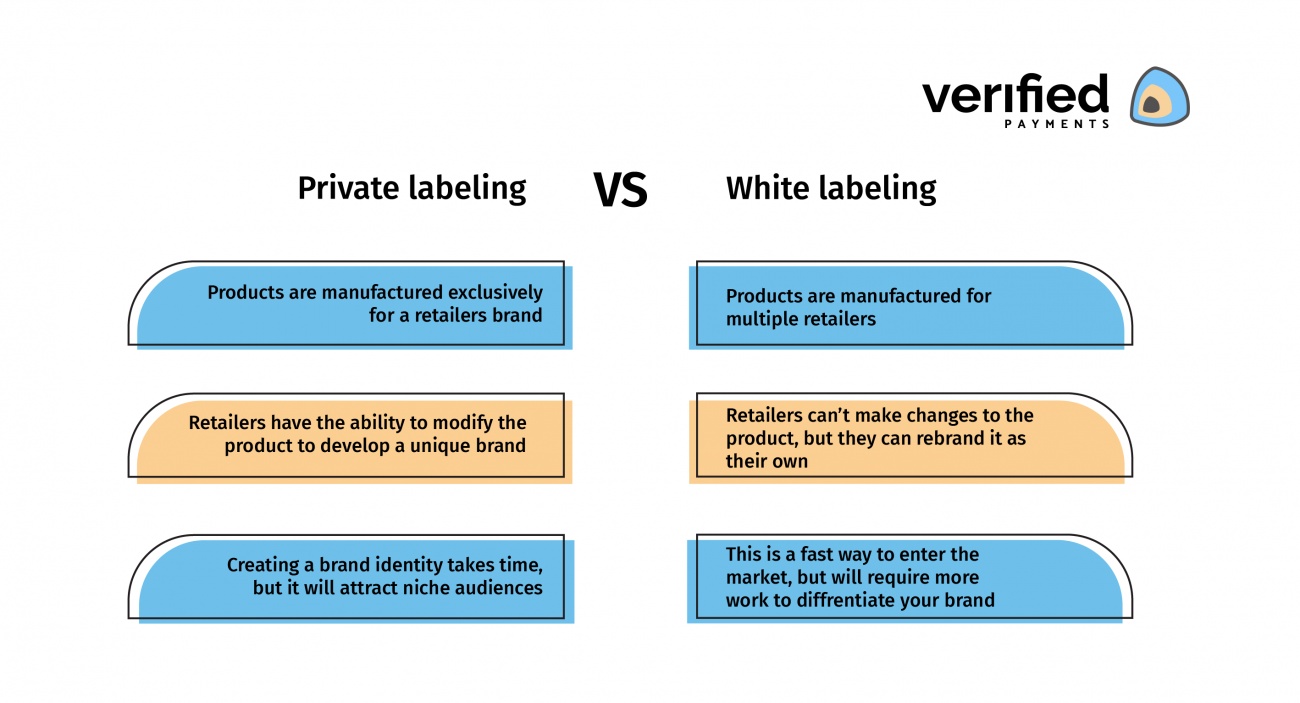

Key differences between private label and white label.

Key similarities:

- Third-party manufacturers. Both models suggest that a product or service is developed by a third-parties, then rebranded, and sold by another company.

- Control over marketing and sales. In both cases, a reselling company is in full control of advertising and marketing. It can give the product or service any name or image.

- No trademarks. No trademarks of a developer remain so customers usually have no idea that the product or service they have purchased was actually created by another company.

- ROI highly depends on the market and marketing efforts. Both can be highly profitable if done professionally.

Key differences:

- Exclusivity and customization. These are features where the major difference between white-label and private-label lies. Private-label products are developed and/or customized exclusively for one specific company so the competitors are not likely to have similar products.

- Easier to enter the market. In specialized industries, white-label allows entering the market more quickly and easily as it provides pre-built solutions. Uniqueness is generally created through branding and marketing.

- Industry choice. Private-label is generally more common for physical products such as cosmetics, household items, outfits, etc. White label, on the other hand, is a widely-used business model within the technology sector, especially in IT, marketing, and ad tech. White-label can be used for physical products as well, so the scope of this model is somewhat bigger than that of private-label solutions.

- Investment. Since private-label solutions are more exclusive and customizable, they take more time and effort to be developed. As a result, they are also more expensive.

Advantages of white-label over private-label solutions

- The white-label solution is the best choice when a low price and speed to the market are of high priority. Speed is especially important for technology, banking, and other complex sectors, where the process of developing a new solution may take months or even years.

- It is easier and cheaper to maintain a white-label product.

- The reseller needs no additional research on or development of the product as the company that develops the product is an expert in the field.

- Potential profits are higher as white-label solutions generally cost less.

Advantages of private-label over white-label solutions

- Private-label is a far better choice when customization and exclusivity outweigh low price and the need for speed to the market.

- It provides better control of the end product, customer journey, design, etc.

- Private-label can look and feel like an entirely unique product of a certain reseller. This feature helps to stand out from the competition.

- It also has good potential regarding profits. Private-label solutions also make it is easier to start without huge investments when compared to product development in-house. Especially when you choose the right target niche successfully.

Conclusion

Whether you are looking for a private-label or white-label banking solution, consider contacting Verified Payments. We mainly focus on white-label services but we can provide exclusive customization options depending on your needs.

* Most probably they already provide their own banking services under a slightly different brand. Much like Verified Payments does. You are welcome to experience our white-label banking solution through the eyes of the end-user at Verifo.com.