It is fair to say that embedded finance is a hot topic in the investment community. As Techcrunch.com notes, “fuelled by cloud technology and a plethora of new fintech and banking-as-a-service startups, there is no doubt the embedded finance trend is accelerating.”

Yet, why are investors so interested in it? Is it some sort of new technology? Will it offer a groundbreaking solution to the problem we never knew existed? Can it change our lives? The answers are: “No,” “No,” and “In a way.”

So, where is all the rage coming from? Let’s find out.

What is embedded finance?

The concept is not new but it is beautifully simple. It is as old as two companies aiming to make our lives a little bit easier. As a result, making us spend a little bit more on the way.

Yes, it does sound like any other business partnership, but the difference lies in the details. In this instance, in company types.

Embedded finance is when a non-financial company integrates a financial service into its product. The ultimate goal for this cooperation is to offer customers more convenience. As the rule of thumb says, the easier it is for a customer to spend money, the more money they will spend.

The beauty is that the variety of industries where financial services are embeddable is unlimited. Any business can start offering them to broaden their customer propositions. You will see it for your own, as we will back up this statement in the section Examples of embedded finance.

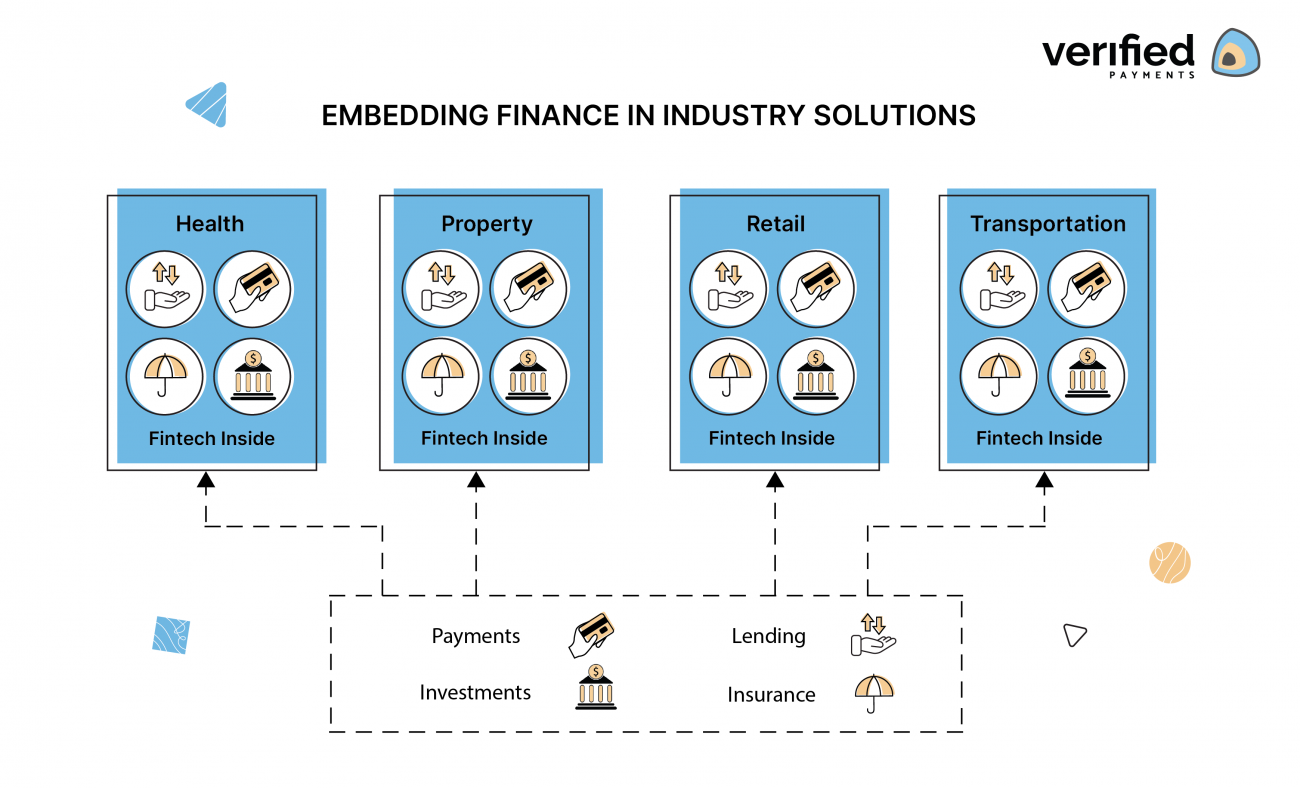

What industries can adapt Embedded Finance?

What is all the fuss about?

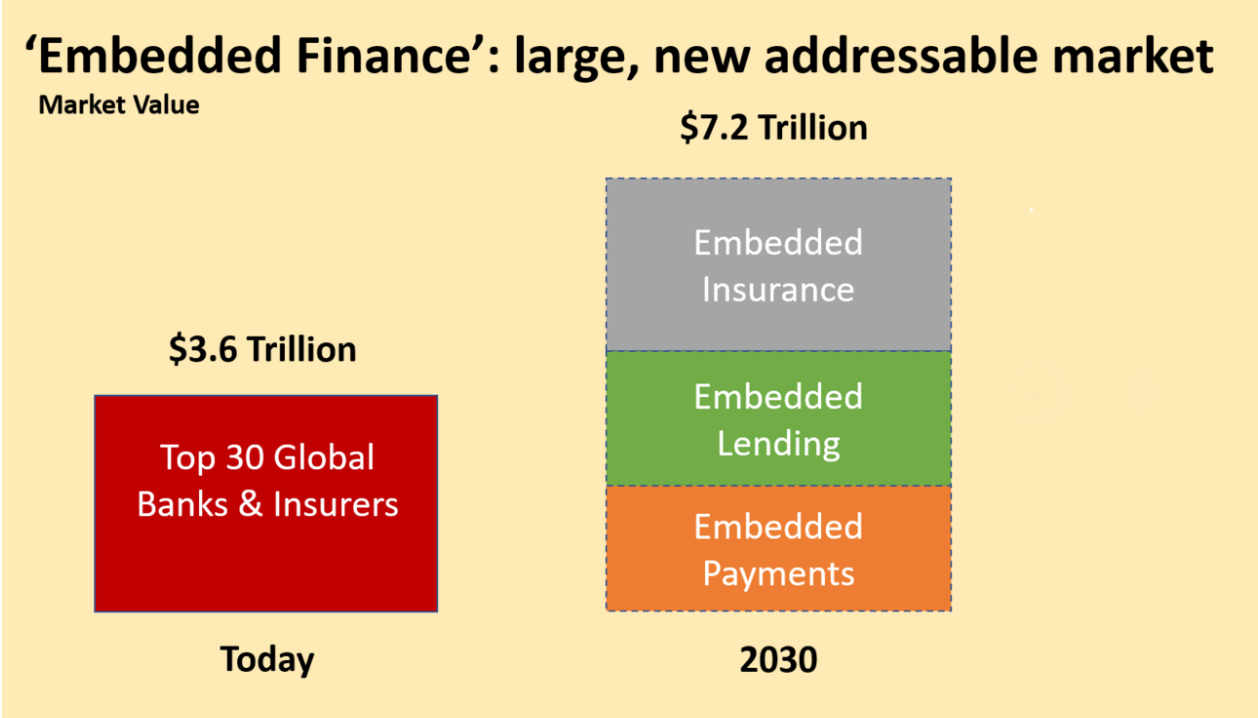

Let’s say that experts see a bright future for embedded finance companies. For example, Business Insider called it a $7 trillion opportunity. No wonder investors want their piece of the pie.

Business Insider named the phenomenon. But Simon Torrance calculated the number. According to him, “embedded finance offers a new, very large addressable market opportunity.” Namely, he estimates that by 2030 the market will reach $7.2 trillion.

Embedded finance: large, new addressable market. Source: Simon Torrance

Benefits of embedded financial services

As mentioned above, the ultimate goal of embedded finance is increasing convenience. The ultimate motivation to do it, though, is way more rational – to increase sales.

Some estimations show that embedding financial services increases revenue twofold. Others say that it can rocket as much as 5 times, depending on the business.

These numbers alone are a good reason to consider embedding financial services. However, they offer even more advantages to all the parties involved:

- Providing financial services when a customer needs them the most.

- Enabling brands to satisfy more needs of their customers.

- Helping financial institutions to acquire more clients.

- Helping brands to offer new finance capabilities better and faster.

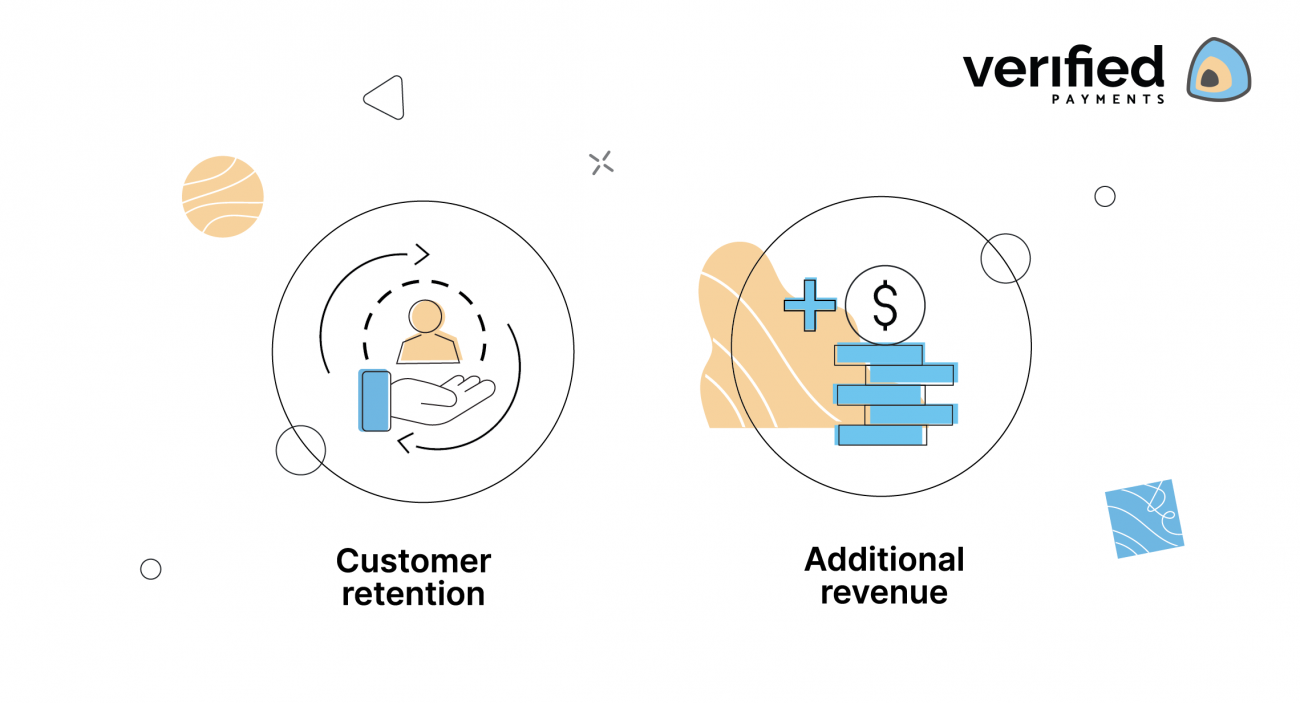

There are two main factors why non-financial companies embed financial services:

- customer retention, and

- an additional stream of revenue.

Generally speaking, customer retention means that a company generates better lifetime value from a customer. It is achieved through increased customer loyalty and lower acquisition costs. In short, this is what embedded finance does – it offers a frictionless, contextual financial experience.

An additional stream of revenue is self-explanatory. Embedding financial services allow a non-financial company to join the financial value chain. Potentially, it leads to decreased costs and higher profits.

Customer retention and additional revenue are the two most important benefits of Embedded Finance.

Embedded finance vs banking as a service

Despite embedded finance being an old concept, the terminology around it is not set. Especially when similar terms are used in conversation. For example, some people use banking as a service and embedded finance interchangeably. They both mean the same – financial services are provided by non-financial organizations. But are they?

Banking as a Service (BaaS)

In short, it is a service that enables a company to provide traditional banking services. This company either:

- does not have the in-house capability to offer a financial service, or

- wants to save time/cost in offering such services.

In this case, by “traditional banking services” we mean credit and debit cards, banking accounts, payment enablement, and the like.

Embedded finance

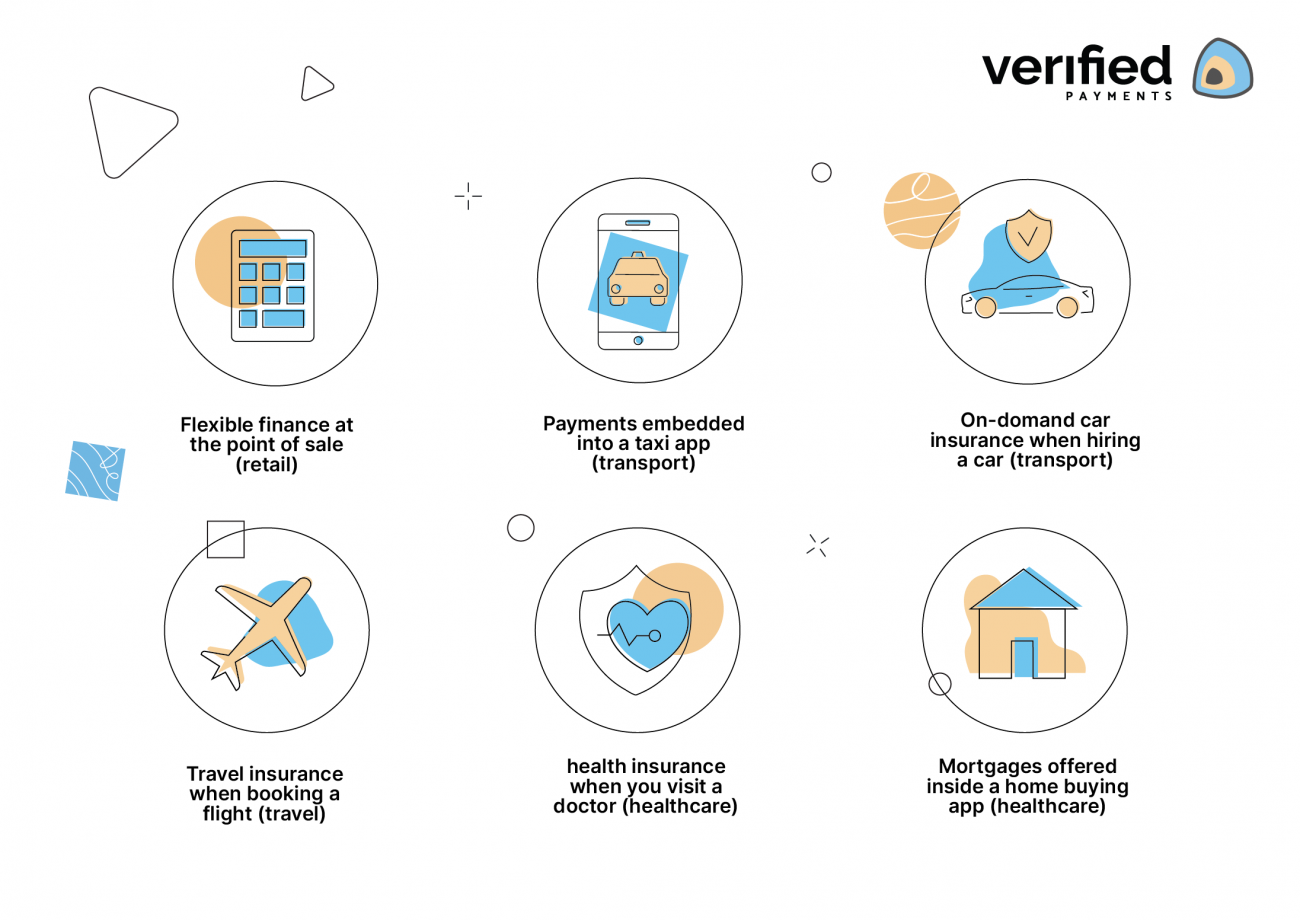

This concept is much broader. Simply put, it means that the financial service is integrated within a product. Payments, lending services, insurance, or investing – all can be embedded. The best illustration of this concept is through examples so let us analyze a few.

Examples of embedded finance

Here you will find a few real-world examples. You already might have used some of them:

Apple Card. A partnership with Goldman Sachs allowed the introduction of the financial tool to its ecosystem.

Shopify enabled merchants to accept payments from VISA, MasterCard, and others. Where’s the trick? The payments are conducted directly through the platform. It avoids third-party payment gateways and their fees. It was the first eCommerce platform to do it.

Uber / Bolt / Lyft embedded payment services. It made the riding experience as smooth and streamlined as possible.

Tesla offers insurance through its car sales program. It allows them to maximize profits from each customer.

Klarna. Technically, Klarna does not embed financial services. Rather, it is a financial instrument that can be embedded. It is best known for providing merchants with a buy-now-pay-later solution. Embedding it on eCommerce pages increases sales and conversions.

Examples of Embedded finance

Verticals of embedded finance

Not only tech companies can make use of embedded financial services. In fact, ANY sector can introduce it to their customers. It will help them to become more convenient and increase their turnover. So, what financial services companies can integrate into their products? Well, all. Actually.

Embedded payments

Embedded payments are probably the most obvious example. Making the process of payment more convenient impacts the bottom line greatly.

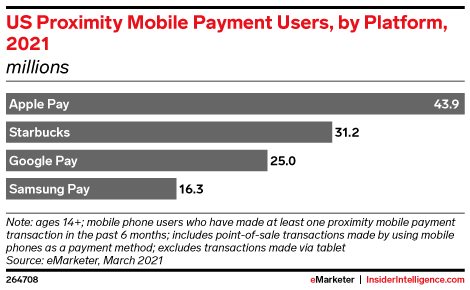

Recently, emarketer.com revealed that Starbucks takes second place in proximity mobile payments. They achieved this position by allowing their customers to avoid standing in line. Now they can make the order and pay for it from their phones. All Starbucks did was offer some convenience.

The Starbucks app is a great example of how embedded payments can benefit the business.

Embedded lending

Lending is another financial service that can be embedded into casual businesses. As payments, it is also very intuitive and obvious. For example, now we cannot imagine online shopping without the “buy now pay later” option. Splitting the price into several payments. That is a great way to increase sales volume and the size of a shopping cart. The aforementioned Klarna became Europe’s biggest fintech by offering this service.

Embedded investment

Investment is not the most apparent financial service when it comes to embedding finance. But it can also be integrated. Acorns app rounds up purchases and invests the change automatically. It simplifies the complicated process of investing to a level that the user does not even think about it.

Embedded insurance

Purchasing insurance is generally a painful and inconvenient procedure. Not for long. Embedded insurance programs cut most of the pain out. When making a large purchase at the same time one can apply for an insurance policy. The process does not require taking extra steps. Previously we mentioned Tesla as an example. Although, a similar service can be offered when purchasing real estate as well.

Embedded banking

Lastly, companies can embed banking services into their business and offer current accounts. This solution offers faster and cheaper settlement between parties. Convenient? Yes. Lyft and Shopify provide similar services.

Trends in embedded finance for upcoming years

Embedded everything? No, thank you

Embedding financial products just for the sake of it is a bad decision. They will benefit neither the customer nor the company. First, a business must figure out what customers need. Only then, they can embed financial products. As a result, we will witness an even sharper focus on customer journeys, UXs, and UIs. Everything to make the life of a customer simpler, more comfortable, and streamlined.

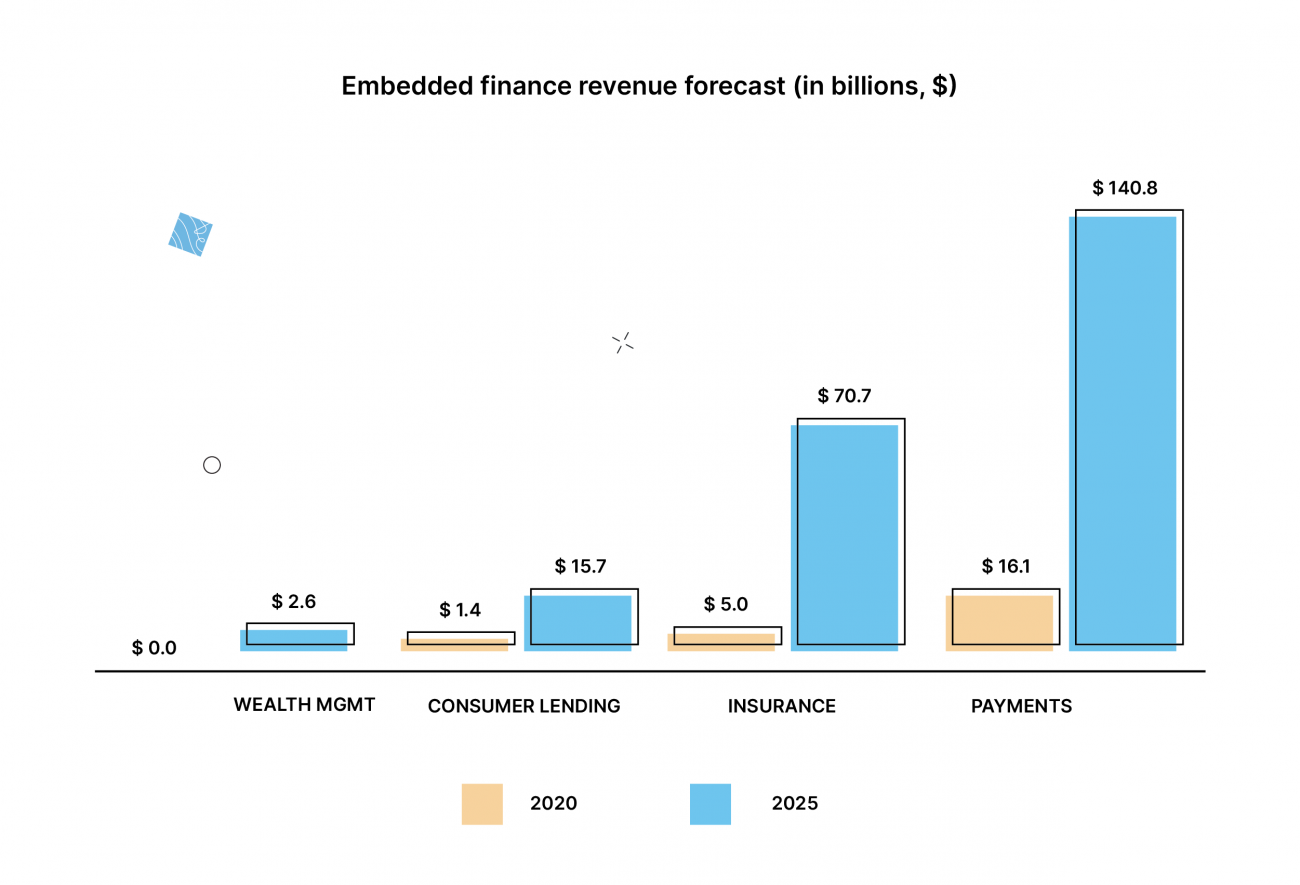

Rise of embedded payments

Not all verticals of embedded finance will be adopted at the same pace. We will see most of the examples in the payment area. It is easiest to put into practice and the results are visible right away. Embedded banking and lending will follow. Their integration is not immediate and it requires meeting certain regulatory requirements. Last, investment and insurance will be the least popular verticals of embedded finance. They are sophisticated and highly regulated products.

Embedded Finance Revenue Forecast (in billions, USD). Source: Lightyear Capital

Licenseless banking

In the next couple of years, we will see the emergence of licenseless banking. Yes, it does sound like an oxymoron but embedded finance and banking as a service allow it. In theory, non-financial businesses can embed as many financial services as they want. In fact, they can integrate most or all banking services and offer them to their clients. It will allow them to create a banking organization that is not a bank. Yet, this might happen only if two conditions will be met. First, the regulatory bar to become a financial institution must be high. Second, and even more importantly, there must be demand from the market. Such organizations must offer a better alternative to existing services. Or target a niche that is not addressed by existing financial institutions.

Innovation from regulation

Open banking is likely to drive even more innovation to embedded services. The idea behind this forecast is that open banking is in its nature. Basically, it driven by regulators and financial institutions must fulfill it. This results in extra costs. Henceforth, financial institutions will look for ways to amortize them. Certainly, they will look for extra sources of income to do so. In other words, it will come from innovation in the fields of embedded finance and banking as a service.

When embedded finance is worth considering?

Let’s get this straight. The benefits are clear:

-

more convenience for their customers. It translates into higher customer satisfaction, retention, and lifetime value; and

- an additional stream of revenue that translates into higher earnings.

When to consider the Embedded Finance provider?

Almost all companies can embed financial services into their businesses. Yet, the question is whether they should. To find the answer for yourself, consider these three points:

- Does embedding financial services make the user experience better? Will it make their journey more comfortable and pain-free? Or are you innovating simply to innovate?

- Does it make sense financially? Will you be able to justify the costs of development?

- Do you have the expertise and capabilities to work with financial services embedded on top of your business?

How to choose an embedded finance provider?

Choosing the right partner is already winning half of the battle, so please consider:

- In what products and geographies does the partner specialize? Above all, knowing the jurisdiction and its nuances is very important and could save you a lot of trouble. Especially in the area of regulatory compliance.

- What are the plans for product development? Competitors do not wait. Sooner or later other players in the market will offer more and better services for a lower price.

- What are the technical options to switch partners after a while? Being locked with a single partner can result in missed opportunities. Even worse – it might compromise user experience. Therefore, the advice here would be to make a window for “plan B”.

Is the rise of embedded finance the end of fintech?

In short, no. It will bring some changes to the game, though. For a long time, fintech companies were disruptive and change-bringing. Embedded finance will change that. As some examples in history have shown, cooperation is better than the competition. Indeed, it looks like fintech companies finally understood that the market is not a zero-sum game. Sometimes, playing along is better for all.

Conclusion

Embedded finance has strong benefits and any product can make the most of it. Yet, there is one rule to follow. A company must examine and identify customers’ needs before embedding financial services. Preferably, by making the user experience more seamless. Otherwise, the embedded finance will not be useful and profitable.

It is hard for us to imagine future businesses without financial capabilities. However you put it, embedded finance is here to stay.