Fintech companies are increasingly gaining momentum in the modern world.

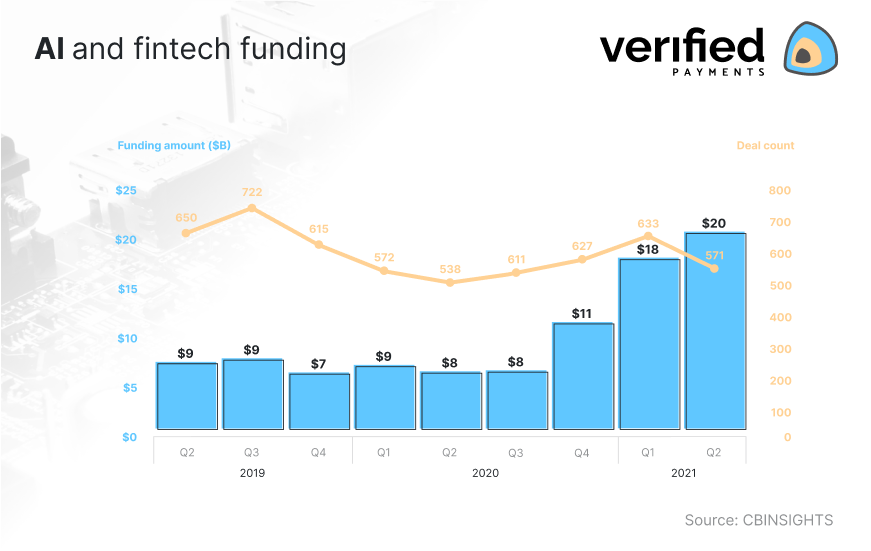

The latest report revealed that Q2’21 was the largest funding quarter on record. Across 657 deals, global venture capital fintech-backed companies raised a record $30.8B, shattering last quarter’s funding record by 30%.

Fintech funding during recent years

Wondering how to get started in fintech? In this article, we will let you take a glance at what it’s like to start a fintech company.

Starting a fintech company is not easy and requires many different steps to take. This article will cover the essential points. You will learn about the complexities of the fintech industry and first-hand advice that might save you time and resources.

How to create a fintech company?

The good news about starting a fintech startup is that each time it gets a little bit easier.

Whether you are thinking about launching a personal finance app or launching a fintech bank, it is a complex process. But we will try to cover the essentials of starting a fintech company within 4 steps to make it easier for you to prepare for future challenges.

- Identify the opportunities for your fintech company

- Risks of starting a fintech company

- Choosing a tech solution for your fintech company

- Get to know regulations for fintech companies

- Final tips

Identify the opportunities for your fintech company

The success of a fintech company lies within its ability to offer value to the target audience. The higher the value is offered to a wider audience, the more successful the company will be.

That’s the theory. In reality, it is not as simple. There is plenty of competition in almost every industry and in order to stand out, you must spot the opportunity.

There are several approaches you can take in order to differentiate your business. To help you out our team shares some of the most popular techniques:

Strategic analysis tools

Before you launch your business for the market it is smart to do your homework. Not only to collect information on potential markets, customers, and competitors but to analyze your product as well. It will help you to crystalize your idea, prepare for challenges, and make informed decisions.

Before we jump into discussing the most popular strategic analysis tools, there is one thing you should remember. No theoretical model can prepare you for what happens when you launch the product. There always will be unforeseen circumstances.

Using the tools below will not help you to prepare for any possible situation. But it will help you to prepare for most. This is best illustrated by the famous quote of George Box: “All models are wrong, some are useful.”

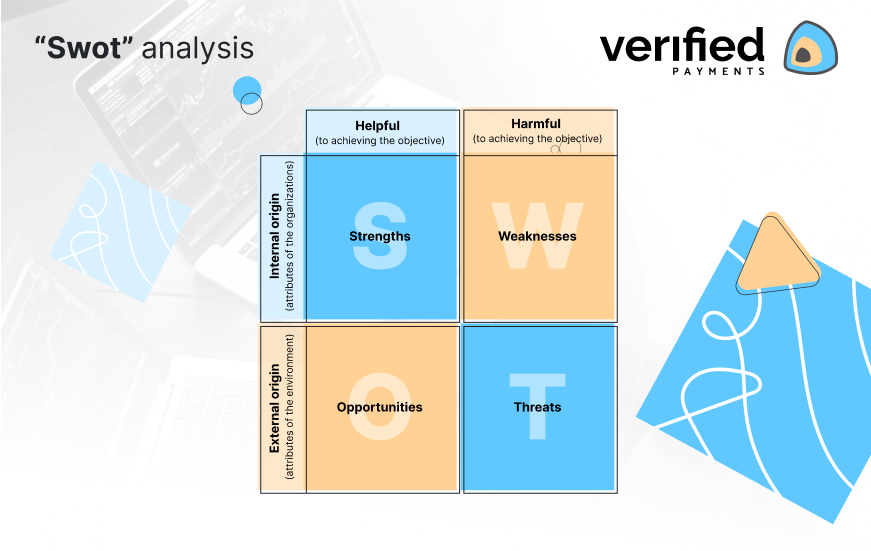

SWOT

A SWOT analysis is one of the most popular strategic analysis tools. It focuses on four key factors affecting your business:

- Strengths

- Weaknesses

- Opportunities

- Threats facing your business

A SWOT analysis typically provides you with valuable information about your business. It can help you to identify ideas that can be used for your startup. For example, introduce new products, alter prices, adjust advertising, or work on customer experience.

The disadvantage of this tool is that it requires some experience and a lot of critical thinking. Also, it generates a long list of strengths, weaknesses, opportunities, and threats. Some of these may overlap and this tool does not provide a way to sort them out.

SWOT analysis

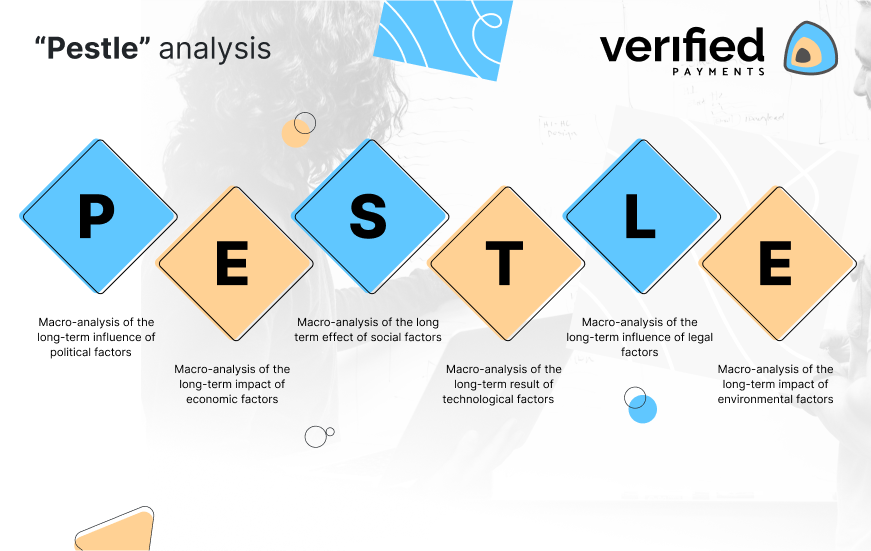

PESTLE

To identify opportunities you can also use a tool called a PESTLE analysis. It is a technique that can help you to understand six external influences:

- Political

- Economic

- Sociological

- Technological

- Legal

- Environmental

By analyzing these factors, fintech startups can gain insight into circumstances that may impact their strategy and business decisions. However, some of these external factors change quite quickly. Thus you will need to perform this audit regularly in order for it to be effective.

PESTLE analysis

Trial by market

SWOT and PESTLE tools are great for spotting business opportunities. But what if you do not have the time? In such a case, you can launch the product to the market and adapt it on the go. There are four sources of valuable insight that will help you spot the opportunities.

1.Potential clients and past leads

This part is both self-explanatory and tricky at the same time. On one hand, it is obvious that you should listen to the needs, wants, challenges, and frustrations of your potential clients.

On the other hand, it is not always easy to obtain this information. Sometimes they will tell you. Other times you will have to find creative solutions to extract their insights.

2.Your existing customers

When you are trying to identify a million-dollar opportunity, listen to what users are saying about the industry and your competitors. Try to understand their experiences and frustrations. Pay attention to feedback and complaints. This information can help you to discover business opportunities that other players in the market missed.

3.Competitors

Do a little competitor analysis to see what other startups are doing, and most of all what they tend to avoid doing. You can get some valuable information by trying to answer these questions:

- How other fintech companies are achieving success?

- What makes customers go to your competitors over you?

- How you can adjust your strategy accordingly?

Analyzing your competitors will help you determine key business opportunities to get your startup expanding.

4.Market overview

Absorb yourself in the fintech industry and continually educate yourself on the latest technologies and trends. Subscribe to the industry publications, associations, set Google alerts for key terms, follow the fintech news, and other industry experts on social media.

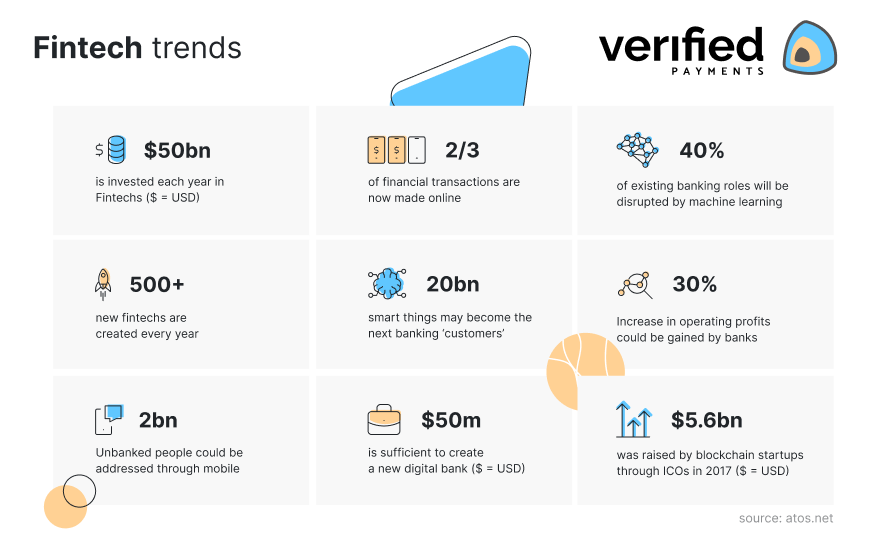

Fintech trends

It may look like the industry is saturated with various fintech innovations but it is not. Lending and payments are getting most of the attention but there are plenty of opportunities in investment, banking, insurance apps, and many other fields.

In this industry, the easiest way to create opportunities for yourself is to apply new technologies to existing financial services. Our team collected ten practical ideas of how you can innovate through technology.

- Mobile banking and financial inclusion for underserved

- Smart Personal finance management

- Affordable and easy accounting for small businesses

- Innovative and money transfer processing

- Peer-to-peer lending and micro-financing

- Accessible investing and online trading

- Simplified crowd-funding

- Big-Data and predictive analytics for fintech

- Digitized insurance experience

- Blockchain and digital currency

Current fintech trends

Niche Opportunities

There are also ways to think outside the box when looking for business opportunities in the fintech industry. Sometimes the segment of the market you are targeting is the key to success.

A fintech startup called “Welcome Technologies” raised $35m during a fundraising round for the purpose of building a fintech app for immigrants. There are 45 million immigrants living in the USA and they are underrepresented in the types of financial services being offered. They struggle to get services ranging from debit and credit cards and education services to health care, insurance, and utility bills. It shows that existing companies may have done a poor job of building access to a large potential customer base.

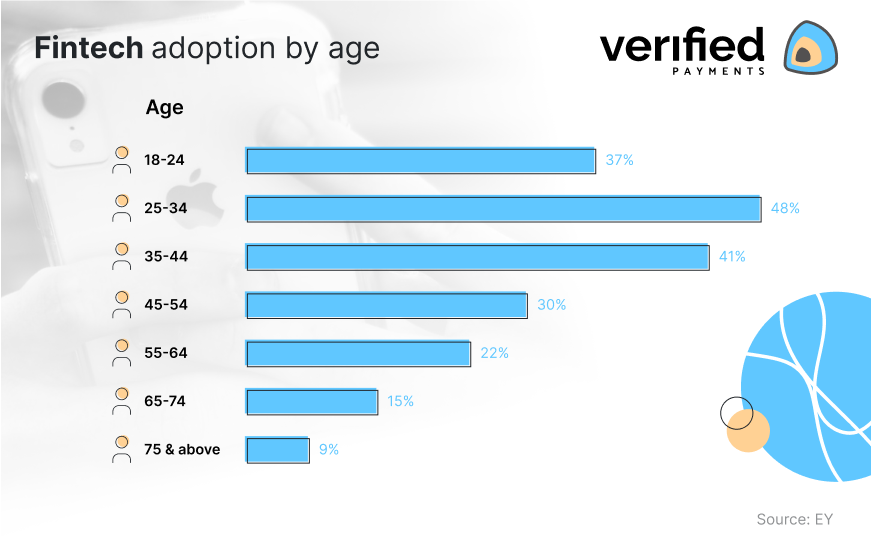

Another demographic segment that is overlooked in the fintech industry is the older generation. This segment is also accompanied by the bias that older customers are not invested in the latest technologies. Consequently, some fintech companies believe that getting them to convert is too much effort for the pursuit of growth.

Other startups may have a different take on this approach. Some of them find success in developing services aimed at improving the financial well-being of older individuals. Usually, the scope of these startups is fraud prevention, retirement fund management, estate, wealth, and legal services.

When you start a fintech company you might also want to consider that the main customer base is millennials. Fintechs have won the respect of the young by focusing on their ability to offer speed, simplicity, and value. Rapid adoption rates of the younger generation have been one of the key driving factors behind the rise of fintech.

Fintech adoption by age

When developing a fintech idea an analysis of the demographics segments is crucial. It allows your idea to be more tailored for your determined market segment.

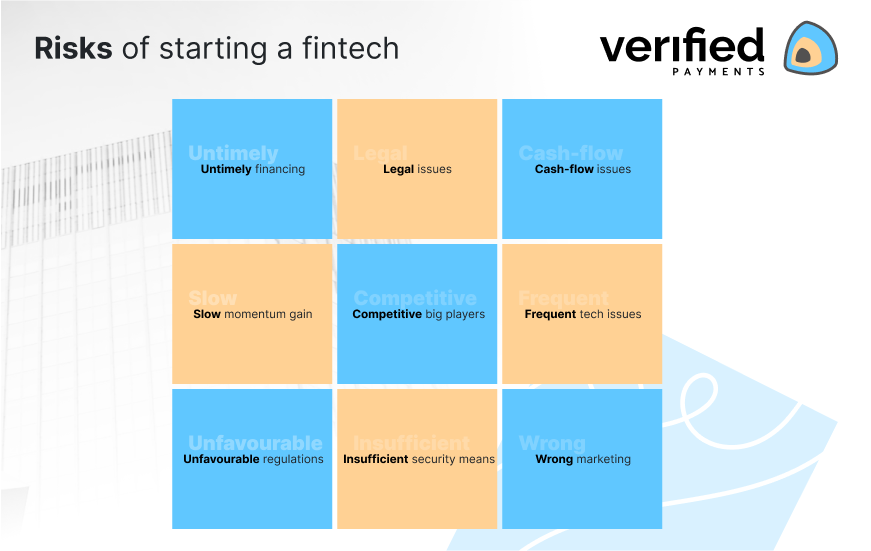

Risks of starting a fintech company

Launching a fintech startup comes across as a promising venture. If you succeed, you could change the world. Only one out of ten startups is considered successful.

As glamorous as fintech may seem, one must not forget that much like any other business, it has its own risks and challenges. We listed a few that our team sees as the most crucial to keep in mind.

- Raising capital or strategic financing too early or too late

- Being too dependant on regulators or being not able to work around regulatory requirements

- Directly competing with huge financial brands

- Using the right marketing to attract customers

- Slow sales cycles are common in the fintech industry

- Underestimating the importance of cybersecurity and data privacy

- Facing Intellectual property and technology issues

- Facing cash-flow issues

- Other Legal Issues

Risks of starting a fintech

Choosing a tech solution for your fintech company

When you approach this part of your fintech business development you ought to make a choice. Either you choose to develop a custom fintech software or you use white-label solutions. Each of them has its own pros and cons which we will discuss below.

Pros and cons of a custom solution

Pros:

- Infinite customization options

- Better control of the end product

- The authenticity that may help you to stand out

- You can develop all features your customers need

Cons:

- To develop custom software is very costly, even if you have developers on the team

- Additional research and careful development planning is required

- Due to high development costs, your solution may bring in smaller profits

- Increased number of security and compliance risks

- You will need a much bigger tech team

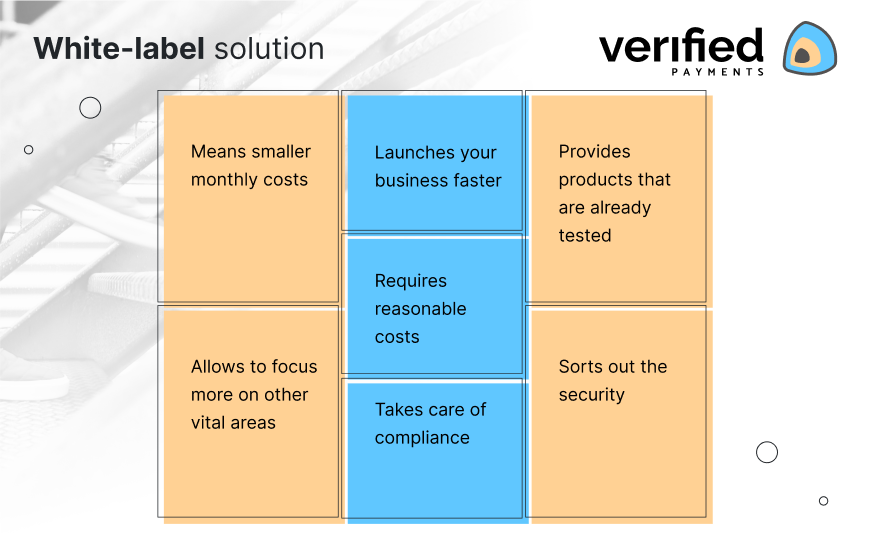

Pros and cons of a white-label solution

Pros:

- Faster launch of a business idea – quicker you enter the market, the sooner you can start scaling or pivoting the idea

- Investors are more interested in products that are already tested by the market

- Stable month-on-month costs allow planning budget better

- No need for a huge initial investment

- Allowing you to focus on the other vital areas: business development, sales, and marketing

- Most often is a more secure option

- White-label fintech solution providers can cover compliance as well

Cons:

- UX/UI is adjustable to some degree

- Features are limited to the ones that are provided. Others can be developed for an additional cost or integrated as a secondary white-label solution

- You are somewhat dependant on how the white-label software will be updated

Advantages of white-label solution

Important note:

It is crucial that you take special care of the security means in your fintech startup. If someone manages to hijack your precious data it can critically undermine your operations.

Security concerns in the fintech industry are not something to be overlooked. Your startup will likely require a highly certified and trained cybersecurity professional to adopt and maintain the new technology.

Get to know regulations for fintech companies

It is a fact that fintech companies are regulated. You will have to learn about the ins and outs of this highly complex sphere. Including the regulatory authorities, laws, legal limitations, requirements, and general data protection regulation. These regulations may address the products or services themselves or related issues like:

- Investment fraud

- Securities of cryptocurrencies

- Systemic risk regulation

- Central bank functions

- Money laundering

- Taxation

Planning to set your fintech company for a global launch? Take into account that the laws differ from country to country (or even state to state). However, if you are planning to operate within the EU, you can take advantage of the passportable licenses. It means that after acquiring a license in any EU member state you can provide your services in all other member states

This benefit was extremely apparent when Brexit was taking place. British companies were dominating financial services in Europe. Although after the UK leaving the EU their services would have been limited to the homeland only.

It drove British financial institutions to acquire licenses in the EU in order to keep providing their services. Some countries, like Lithuania, displayed flexibility and proactively invited these companies to relocate their enterprises. As it is also considered one of the most fintech-friendly countries in the world. Lithuania was successful in attracting some big players, for example, Revolut.

The regulatory environment in fintech

Final tips

These different steps should not be considered in a sequential fashion but rather separately. You can find that these steps can correlate quite closely.

Starting a fintech company is a complex process that requires careful coordination. You can get too immersed in the development of your idea and the design of your product.

The fundamental notion in fintech companies is to quickly and effectively enter the market. When you start generating revenue investors will consider it as approval of your business idea.

While investments are crucial for startups to grow, do not focus solely on them. Great sales and business results are what investors want to see. So, prepare the product and enter the market as quickly as possible.

Best fintech companies test the idea in real-life conditions and are not afraid to pivot.

The fintech industry became a giant just recently. Some of you might be surprised that the concept of fintech emerged back in the 19th century. In our other article, we go more in-depth about what is fintech.

Verified Payments helps your fintech company

Verified Payments provides white-label fintech solutions for companies of all sizes. Our solution includes a core banking platform, compliance services, and EMI umbrella. Contact us by phone: +370 616 59976, or by email: [email protected].