Thanks to fintech the way we understand finance is changing. The traditional systems we used just a couple of years ago already seem outdated.

Their secret lies within their genes. The last generation of fintech companies was born during the recovery of the global recession. That is why they are constantly adapting and evolving to meet the needs of their clients. And that is the reason why the fintech industry has shown resilience to market fluctuations throughout the years.

The Fintech industry has shown resilience and tremendous growth despite the market fluctuations. The functionalities of fintech continue to expand and are replacing traditional solutions. The Global Fintech Market was valued at 5504.13 Billion in 2019. It is further expected to grow at an annual growth rate (CAGR) of 23.58% during the forecast period.

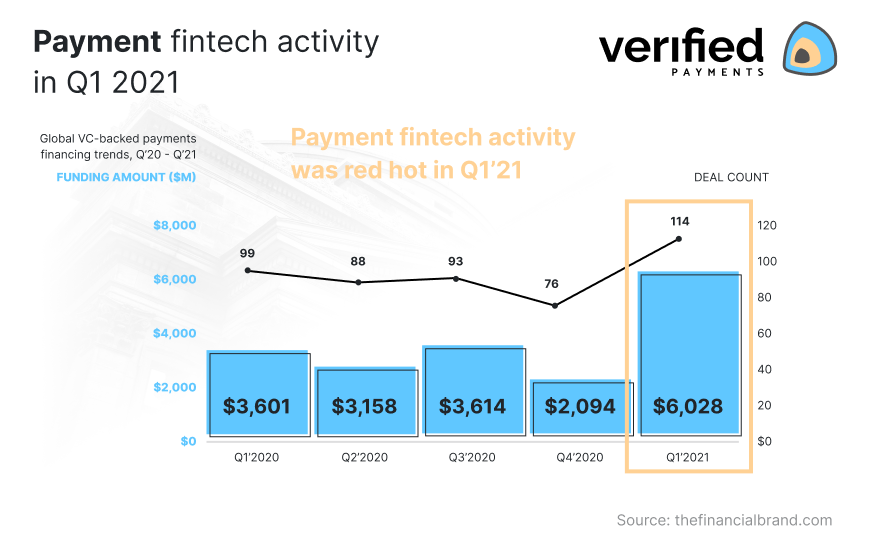

Global fintech financing trend

Fintech shifts the perception of financial services. The traditional financial systems that are still used today are becoming outdated in comparison to the latest innovations. Fintech companies come up with more convenient solutions making it the biggest competitor of traditional banks.

In the article below you will learn about:

- Fintech definition

- History of fintech

- Fintech innovations

- Technologies used in fintech

- What do fintech companies do?

- Future of fintech

Fintech definition

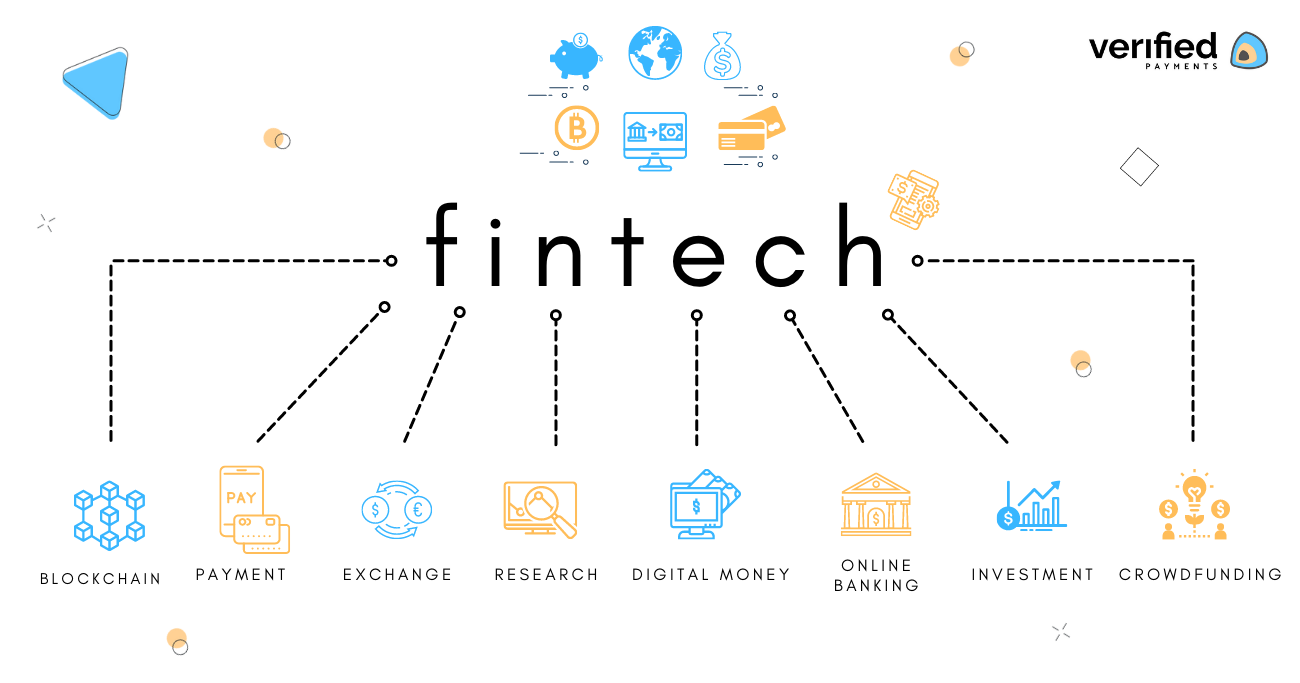

The term “fintech” is a combination of two words – “financial” and “technology”. Fintech meaning is usually described as a technology that is being applied to improve financial services. It is a broad concept and can cover everything from new apps and processes to products and business models.

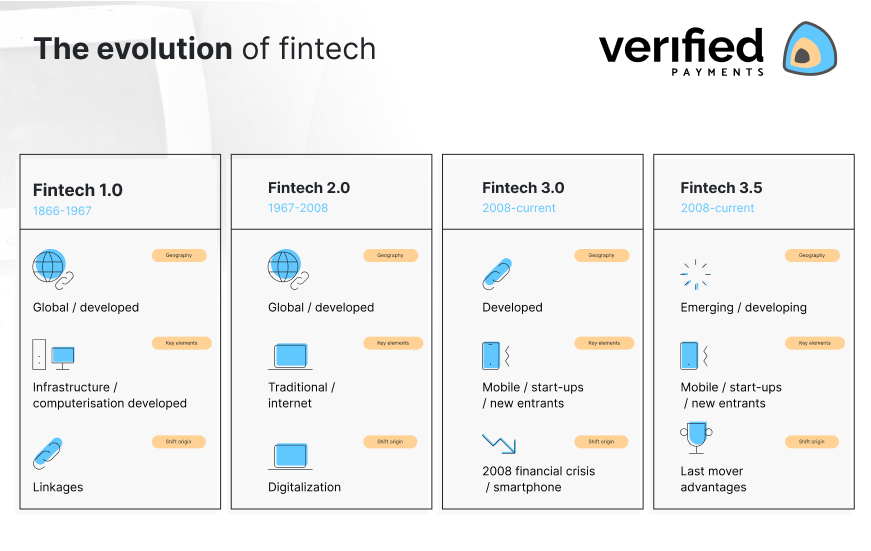

History of fintech

Some people are surprised to hear that this concept emerged in the 19th century. However, the term fintech is considered to start in 1866 when the first transatlantic cable was successfully laid. It provided fundamental infrastructure for the period of intense financial globalization from 1866 to 1913.

1918 brought us Fedwire. It was the first electronic fund transfer system operating with the help of telegraph and Morse code. Later on in the 50s, the public was introduced to credit cards by Diners Club and American express. Until this point, this marked the end of the fintech 1.0 era where services were connected with technology but remained analog.

Later the developments like ATM, the first digital stock exchange, and SWIFT payment messages further propelled financial services. They can be considered the beginning of financial markets and communication protocols that are used to this day.

The 1990s saw the first drastic movement towards digital banking. The world increasingly went online so it did not take long for the new digital payment methods to enter the market. In 1998 PayPal took the world by storm by offering low-cost, almost effortless digital payments for consumers and businesses.

The 2008 financial crisis contributed towards the start of the modern fintech era. People lost their trust in traditional banking services. A post-crisis trustless environment turned out to be a perfect setting for new fintech businesses to emerge. The new developments were quickly considered as convenient alternatives to traditional banking and were quickly adopted by many.

Currently, a majority of consumers use fintech services: 75% use money transfer and payment services.

Fintech innovations

The past few years have witnessed significant developments in the industry. Some fintech examples include mobile payments, digital currencies, blockchain, and principles of lending. The developments in this industry were made by non-bank entities and have mostly arisen outside traditional financial systems.

The future of fintech

In addition, these fintech ideas enabled a better understanding of clients’ financial needs. They transformed the customer experience by promoting a more client-centric and interactive approach to financial and banking services.

As of now, fintech companies are responsible for the majority of revolutionary changes in the financial industry. The interest in these new developments keeps increasing.

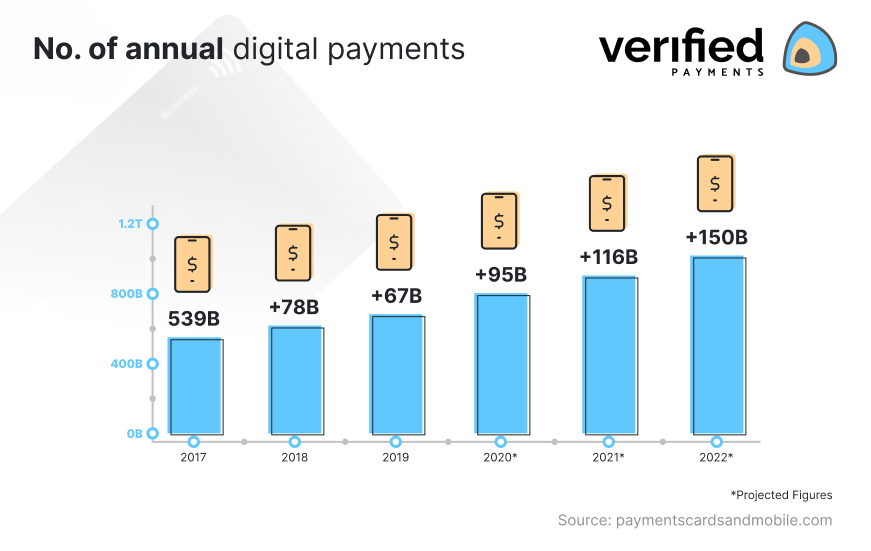

One of the biggest fintech products is digital payment, which holds 25% of the fintech market.

No. of annual digital payments worldwide

Technologies used in fintech

Fintech companies usually employ advanced technologies in their products. These technologies facilitate customer experience throughout all spectrum of financial services.

- Artificial Intelligence (AI) algorithms integrate into financial services in multiple ways. For example, they can help analyze the spending habits of customers in order to offer them personalized services. They also can help to detect fraud or reduce back-office costs by taking on a load of customer service. Overall AI aims to improve the efficiency of current methods of human intelligence at a beyond human scale.

- Big data sets transformed the value generation for the financial services industry. These massive heaps of data are able to provide fintech with valuable information regarding customer activity and its tendencies. Also, big data analysis assists with expensive tasks of credit risk scoring, providing assessments faster and more affordably. It helps different businesses to determine the precise consumer awareness point to provide a timely offer.

- RPA (Robotic Process Automation) are software robots used to identify, learn, and mimic human actions and interactions with a digital system. The main advantage of an automated investment advisor is that they are low-cost alternatives to traditional advisors. They are able to estimate the outcome of a custom investment strategy. This helps out many companies and individuals to determine potential risks and the impact of their decisions on their finances.

- Blockchain is one of the key technologies in fintech which is based on the concept of equity and decentralized networks. Based on cryptographic technology it helps fintechs to provide a far more seamless and effective alternative to banking. Blockchain in fintech helps enable more efficient transfers of funds, improved security, and transparent financial tracking.

What do fintech companies do?

More efficient and user-friendly fintech innovations disrupt the traditional financial service industry.

The fintech growth is demolishing the walls that have long surrounded the traditional financial and banking systems. New fintech startups emerge to challenge the conventional business methods of traditional banking institutions.

This ongoing shift within the global financial industry creates new opportunities for value creation in the financial industry. Below you will find 6 markets where currently fintech businesses excel and dominate.

Money transfer

Fintech has played a major role in simplifying the process of transferring money abroad. These innovations have allowed users to transfer money internationally in a variety of ways.

Thanks to the innovativeness of this industry, consumers are able to do a cross-border fund transfer through their smartphones. Prior to this, they had to visit physical branches of banks and financial institutions to send money abroad.

Technology-based shifts have changed the landscape of international remittance. Many people start to tune into fintech’s latest money transfer apps for multiple reasons:

- Faster services than banks

- Lower exchanges rates

- Lower total cost

- Multiple payment methods

- Perks of Big Data

- Accounts for multiple currencies

- Enhanced security

Over the years, the growth and popularity of money transfer services significantly contributed to the rise of the fintech industry. Many investors still find it worthy to develop money transfer services.

One of the distinguished examples of money remittance companies is Wise. It sees its valuation climb to $11 billion in 2021. The value of this company almost doubled in just under one year. Wise focuses on unfettered transfers, smart technology to manage savings, and a convenient interface that allows quick transfers. The current shift to digital banking platforms can be highlighted by this stunning growth.

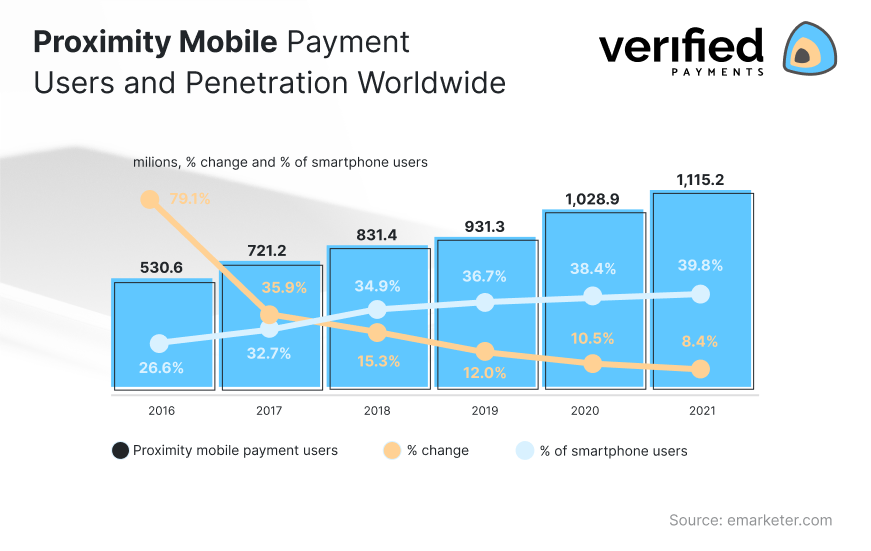

By 2021 there were roughly 1.12 billion mobile payment users with mobile devices globally.

Number of mobile payment users worldwide

Blockchain technology

Cryptocurrency and blockchain change the way we perceive money. This technology is a decentralized network with a strong focus on cryptography, security, and privacy. This is what makes fintech and blockchain blending in well together.

Such technology allows real-time data tracking. It is an effective method to record transactions without intervention.

The reliability of blockchain has given opportunities for new companies to create secure and safe financial products. Moreover, considered to be one of the biggest driving forces behind innovation in the financial sector.

Here are a few examples of blockchain in fintech:

- Digital identity (security)

- Trading

- Payments across the world

- Investing and lending

- Auditing

Open banking

Open banking is another fintech practice. These innovations are specified by open-source application programming interfaces (APIs). It is a secure way for providers to access your financial information.

For example, such an interface allows customers to initiate the switch from one bank to another without being physically present. That is where open banking allows financial service providers to access personal consumer data such as:

- Bank account information

- Transaction history

- Spending habits

- Credit reports

Open banking plays an extremely important role in fintech. That is why we wrote an in-depth article about it. If you would like to know more about the history, benefits, and use cases, check our blog post on Open Banking.

Insurtech

Insurtech might come across as a strange and unfamiliar term. Apparently, this niche generates a significant portion of the global insurance market that is valued at $2.72 billion in 2020.

Insurance companies are on the lookout for opportunities to save money. For this purpose, they employ a broad category of technologies labeled as insurtech.

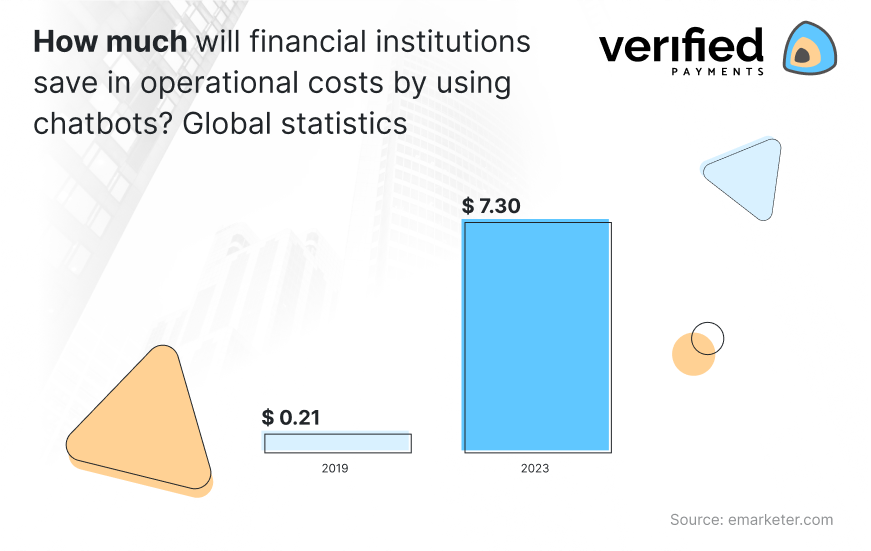

Developers of the solution typically aim to enhance backend processes and improve the customer experience. For example, they can design a chatbot that is able to alleviate the workload of customer service employees.

Fintech AI chatbots ($ billions)

Another example of insurtech is smartphone apps that allow managing licenses and complex paperwork. Managing it through a mobile device saves time and resources for both customers and the company.

Regtech

Over the past decade, financial regulators have been encouraging institutions to undertake updates regarding shifting fintech regulations. Coping with the sheer volume of new fintech regulations imposes a strict and high complexity agenda on financial institutions. That is where regtech emerges to help financial institutions.

Financial institutions employ regtech to work with new and evolving fintech regulations. It is able to determine what-if situations and propose robust solutions on changing regulatory frameworks. Regtech helps reduce risks and frauds, adapt to the ever-changing environment faster, and simplify the management of data and reporting.

The global regtech market size was valued at $6.5 billion in 2020 and is forecasted to increase by almost ten-fold by 2025.

Robo-advisors

Automated investment management is a data-driven service for wealth management.

A typical digital advice service collects information about customers’ financial situation and goals. It does it by employing an advanced open banking solution or something as basic as an online survey. Then robo-advisor utilizes its predetermined algorithm to offer different investment strategies or even execution of automated investments.

These digital services suits entry-level investors. Robo advisors offers low fees and features that are great for beginners. It makes it a good starting point for wealth building.

By this year, automated investment advisors are expected to manage an extraordinary amount of 2$ trillion in assets.

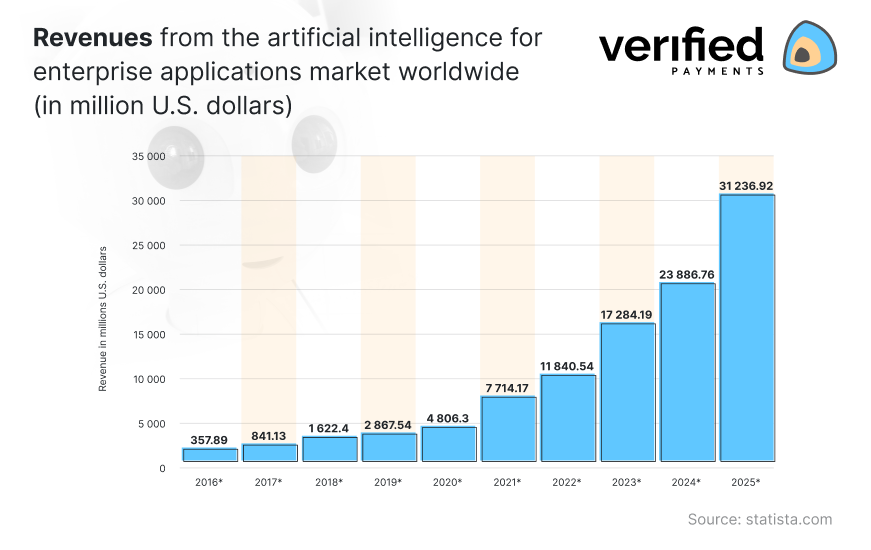

Revenues from the artificial intelligence for enterprise applications market worldwide

The future of fintech

Currently, this industry is very diversified. Along with the latest technologies, fintech solutions are improving the financial sector.

Their influence on the industry is remarkable. Nowadays we witness how fintech will change traditional banking.

These companies offered many useful financial products that we adapted to our everyday lives. Just not too long ago we had to visit a physical bank institution to manage our finances. Thanks to fintech trends, now we can handle it instantly on our mobile devices.

Fintech started as a niche of financial products and quickly became an industry on its own. An industry with a lot of potentials, we might add. Its developments have created billion-dollar industries and banks can barely keep up with the competition.

As this is evolving rapidly, it is exciting to see what the future holds for this industry.